Transaction limit refers to different transaction limits, such as cash out, cash in, mobile recharge, Nagad to the bank, bank to Nagad, etc.

They have different types of limits in different areas. For example, money can be sent 50 times daily and 100 times monthly. In each such case, Nagad has limits. Let us know about these limits in detail.

Nagad Mobile Banking Transaction Limit 2024

Nagad is a digital financial service provider that makes online transactions easy and secure. Nagad has transaction limits to ensure safety and compliance like any other financial service.

In this article, we’ll explore the Nagad transaction limit, which refers to the maximum amount of money you can transact using the Nagad platform.

Understanding these limits is important for managing your transactions effectively, whether you’re a new or existing user. So, let’s learn about the Nagad transaction limit.

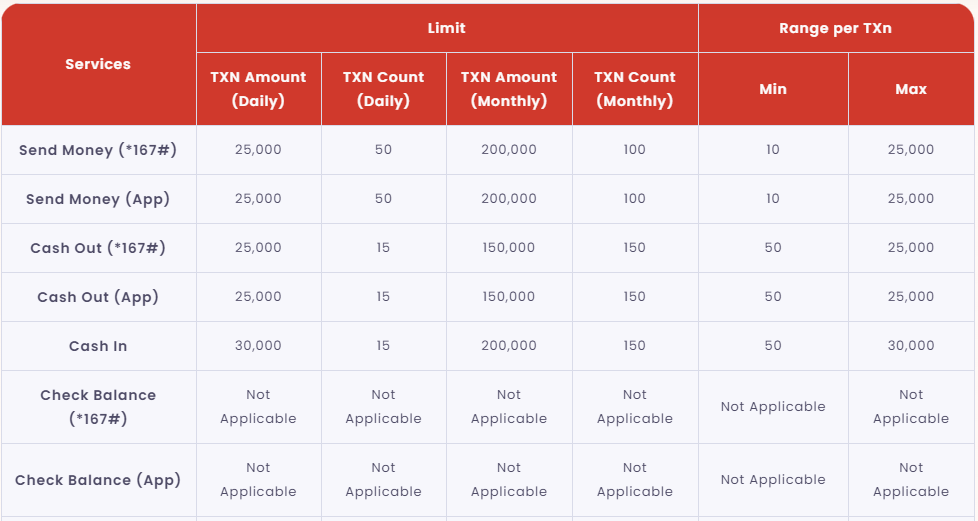

Nagad Send Money Limit

By far, the most that is done from the account is sending money. Anyone can send money from any Nagad account using the Nagad app or the USSD code 10 times a day and up to 100 times a month from the Nagad account.

On the other hand, in terms of amount, you can send a maximum of 25,000 TK and a maximum of 200,000 TK per month.

Nagad Cash Out Limit

People who use a Nagad account usually cash out from a Nagad account by visiting any agent or elsewhere. In case of cash out, it is important to know about the cash-out limit of Nagad. Because if the cash-out limit is full, it will not be possible to cash out even if required later.

Up to 15 times a day and 150 times a month can be cashed out from the account. In terms of amount, you can cash out 25,000 TK each time and 150,000 TK per month.

Nagad Cash-In Limit

Now let’s talk about its cash-in; in the case of Nagad, cash in a maximum of 15 times per day and 150 times monthly. On the other hand, in terms of amount, a maximum of 30 thousand per day and a maximum of 200,000 per month can be cashed in.

A minimum of 50 TK and a maximum of 300,000 TK can be cashed in each time. It is not possible to cash in below 50 TK.

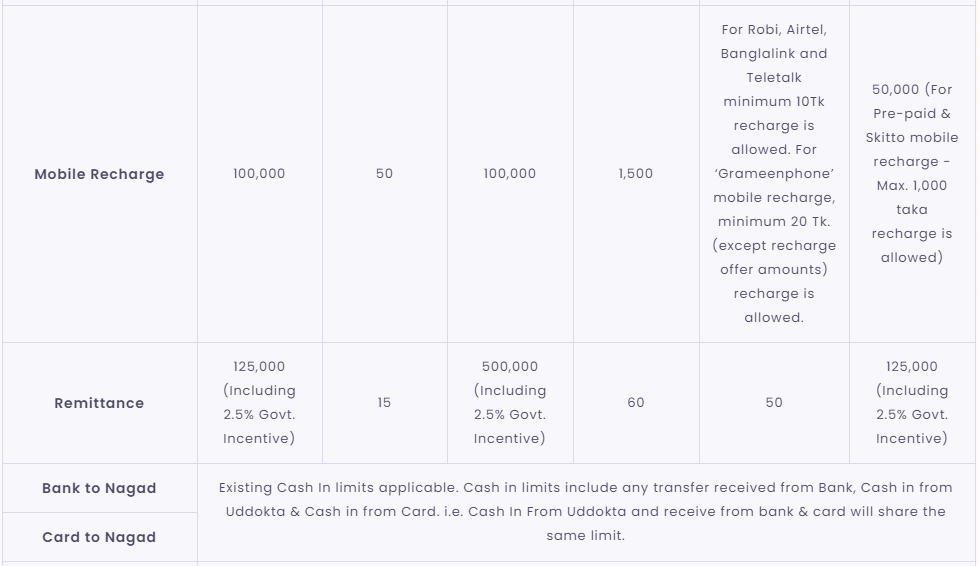

Nagad Mobile Recharge Limit

Now let’s talk about the limit of mobile recharge through the Nagad account. There is a huge limit on mobile recharge through the Nagad account. In the case of mobile recharge through the Nagad account, you can recharge your mobile up to a maximum of TK 100,000 per day and recharge up to Tk 100,000 per month.

In this case, the mobile can be recharged 50 times daily and 1500 times monthly. 50000 TK can be recharged once in the case of Prepaid SIM and 10000 TK in the case of Skitto SIM.

Bank to Nagad Transfer Limit

Now let’s come up with a common query about the limit of money transfers from the bank to the Nagad account. Many people transfer money from the bank. As discussed above, cash in limit will be applicable in case of money transfer from a bank.

In the case of bank-to-Nagad transactions, a maximum of Tk 30,000 per day and a maximum of Tk 200,000 per month can be transferred.

Nagad Translation Limit 2024 Chart

You will understand better if the above discussion is arranged as a translation list in a table form. All transaction limits of the account are presented below in a list form. From here, you can understand very easily.

Conclusion

The transaction limits set by Nagad are important for mobile financial services users in Bangladesh. The transaction limits may vary depending on the type of transaction, the user’s account type, and regulatory guidelines. Users cannot exceed the transaction limits set by Nagad.

FAQs

- Can I send money beyond the transaction limit on Nagad?

Ans: No, users cannot send money beyond the transaction limit set by Nagad. Transactions that exceed the limit may be declined or require additional verification.

- How can I check my transaction limit on Nagad?

Ans: Users can check their transaction limit on Nagad by logging into their Nagad account through the official Nagad mobile app or website.

- Are there different transaction limits for different types of Nagad accounts?

Ans: Yes, Nagad may have different transaction limits for different accounts, such as regular accounts, merchant accounts, or agent accounts. The transaction limits may also vary based on the user’s account verification level and usage history.

- Can Nagad change the transaction limits in 2024?

Ans: Yes, Nagad may change its transaction limits in 2023 or any other time, depending on regulatory requirements, business policies, and market conditions.