Bkash, like other mobile financial services, has transaction limits in place to ensure security and manage risk. Transaction limits refer to the maximum amount of money users can send or receive through their Bkash accounts in a single transaction or within a specified period.

You can send money from 10 times per day to 100 times per month, with a maximum transfer of 25,000 TK per transaction and 200,000 TK per month. Cash withdrawals are limited to 10 times per day and 100 times per month. Bkash Agent cash-outs range from a minimum of 50 TK to a maximum of 25,000 TK per transaction, and cash-outs from 25,000 TK to 150,000 TK per month are possible.

These limits vary depending on the user’s account type, level of account verification, and regulatory requirements.

Bkash Personal Account Transaction Limit 2024

Bkash, the popular mobile banking in Bangladesh, has daily, weekly, or monthly transaction limits for different transactions, such as sending, receiving, or making payments.

These limits are in place to prevent unauthorized access and fraud and comply with regulatory guidelines on financial transactions. Users must know these limits and understand that exceeding them may result in transaction failures or delays.

Bkash Send Money Limit

First, let’s talk about Bkash’s send money limit. When sending money from Bkash to any account, you can send money from 10 times per day to 100 times per month. A maximum of 25000 can be transferred from 0.01 taka per time, and 200,000 TK per month can be sent.

Bkash Cash In Limit

At this point, I will know about Bkash cash in the transfection limit. From any Bkash agent, a Bkash account can be cashed 10 times per day and a maximum of 100 times per month. Cash out from a minimum of 50 TK to a maximum of 30,000 TK per time.

From a Bkash agent, a daily cashout of 30,000 TK and a maximum of 200,000 TK per month can be cashed into a Bkash account.

Bkash Cash Out Limit From Agent

The Bkash Authority has fixed a fixed limit of cash out. Bkash can be cashed out a maximum of 10 times per day and 100 times per month. In case of cash out from Bkash Agent, you can cash out from a minimum of 50 TK to a maximum of 25 thousand TK each time.

On the other hand, from Tk 25,000 per day to a maximum of Tk 150,000 per month, one can cash out from Bkash Agent.

Bkash Cash Out Limit From ATM

The Bkash Authority has fixed a fixed limit of cash out. Bkash can be cashed out a maximum of 10 times per day and 100 times per month. In case of cash out from Bkash Agent, you can cash out from a minimum of 50 TK to a maximum of 25,000 TK each time.

On the other hand, from Tk 25,000 per day to a maximum of Tk 150,000 per month, one can cash out from Bkash Agent.

Bkash To Bank Transfer Limit

Now coming to the bank transfer from Bkash. Many people may need to transfer money from Bkash to the bank. In this case, a maximum of 10 times per day and 100 times monthly money can be transferred from Bkash to the bank.

Minimum 0.01 to maximum 25,000 Tk per bank transfer. On the other hand, a maximum of TK 25,000 per day to a maximum of TK 200,000 per month can be transferred.

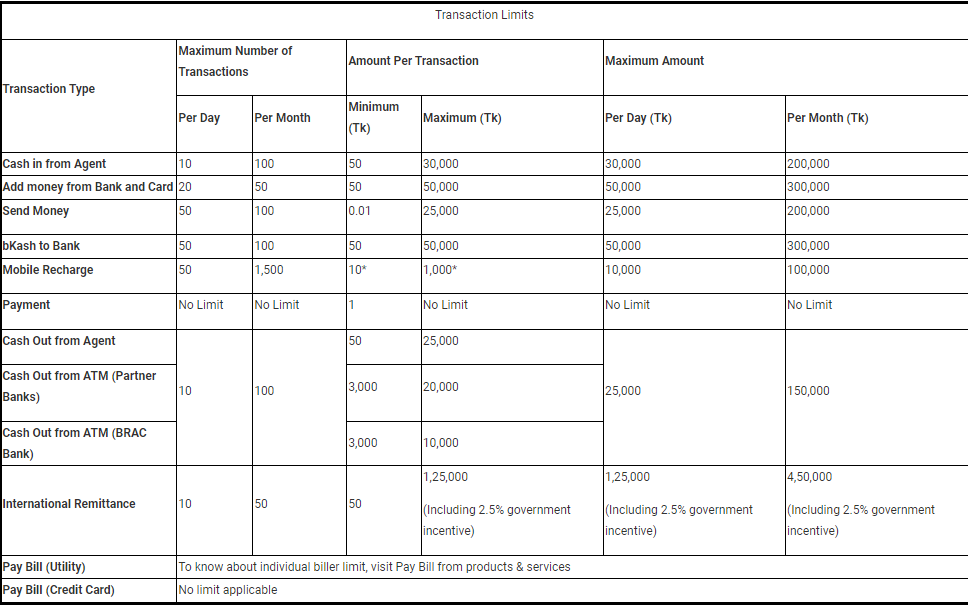

2024 Bkash Transaction Limit Chart

Now let’s look at a nice chart of the Bkash translation limit, which will give you an easy idea about Bkash transactions. Below is Bkash Transactions Limited in the form of a chart image. From here, you will get information about the Bkash transaction limit.

FAQs

- Can I increase my Bkash transaction limit?

Ans: Bkash transaction limits are typically set by the mobile financial service provider and the regulatory authorities, and they may not be adjustable by individual users.

- What happens if I exceed the Bkash transaction limit?

Ans: If you exceed the Bkash transaction limit, your transaction may be declined or rejected. This is because the transaction limits are set to ensure security and compliance with regulatory requirements.

- Are there different transaction limits for different types of Bkash transactions?

Ans: Yes, Bkash may have different transaction limits for different types of transactions. The transaction limit for sending money to another Bkash account may differ from the limit for cashing out from a Bkash agent.

Final Words

understanding the transaction limits for bKash transactions is important for users to manage their financial transactions effectively. The transaction limits may vary depending on the type of account and verification status.

Knowing and abiding by the transaction limits is crucial to ensure smooth and secure bKash transactions.

Bekash payment Parsonl fand add my accunt ok Sobuj Miah