E Return BD or online tax return submission, whatever it is, I will help you go through this now! We know every citizen must pay income tax. A large portion of Bangladesh’s revenue comes from income tax. Failure to pay income tax leads to various problems.

Income tax is a government mandate. If he does not give it, he will be taken the punishment. Therefore, every citizen has to pay income tax. Today’s article will discuss how you can pay your income return online. Let’s know the details of today’s critical discussion.

Online Tax Return Submission Bangladesh 2024

According to the Income Tax Ordinance 1984 of Bangladesh, the annual income expenditure account of every taxpayer in Bangladesh is presented to certain authorities. Based on that, they levy certain taxes to be paid yearly.

E Return BD Minimum Income

Paying income tax becomes mandatory after a certain age limit. This is referred to as the income tax floor in most places. However, the income tax lower limit is slightly different between men and women and in some other special areas in this country. Here it is mentioned-

- In the case of normal and male persons below 65 years of age, the income tax return is applicable if the annual income is more than 3,00,000 TK.

- The income tax return is applicable for normal women and men above 65 years of age if the annual income is more than 3,50,000 TK.

- In the case of disabled persons, the income tax return is applicable if the annual income is more than TK. 450,000

- In the case of freedom fighters who are victims of war, the income tax return is applicable if the annual income is more than TK. 4,75,000.

Also, the income tax threshold will be increased in the case of families with disabled children or dependents. In this case, the income tax limit of any one of the parents or legal guardians for each child will be increased by Tk 50,000. So the person has to file an income tax return or calculate income tax by increasing TK 50,000 over the limit normally applicable.

E Return BD Submission Process 2024

You must go through several steps for online income tax submission. You have to go through these steps very well. You have to follow every guidance given below through which you can submit your tax return online step by step. So let’s know how we make tax return submissions online.

Visit National Board Of Revenue Website

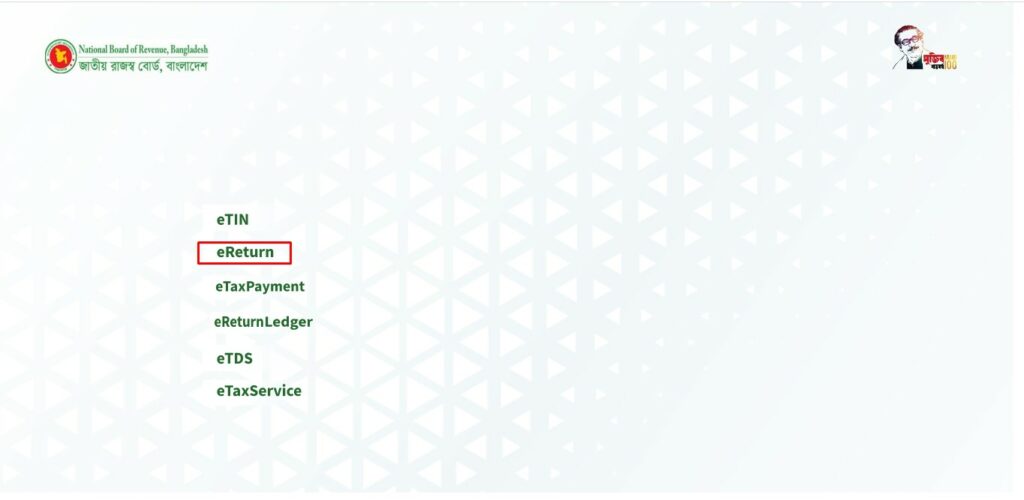

To submit your tax return online, visit the National Board Of Revenue, Bangladesh website.

After entering this link, you will see a page like the image below.

Sign Up to eReturn

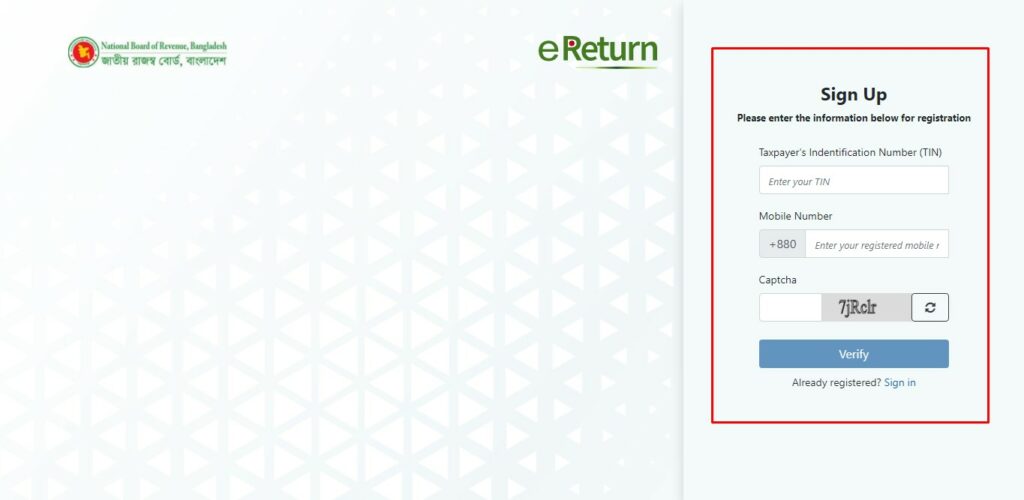

There are several options on this page. From this option, you have to select the red-marked symbol e-return option. After clicking the e-return option, you will see a page like an image below.

The red-marked part on the right side of this page, your TIN and password number, should be entered here. After entering, a captcha is given, which you have to fill in correctly. Fill in and click submit option.

Here it is important to remember that if you want to register afresh, you must complete the registration process by providing the required information by clicking on the registration option below.

Enter Your eReturn Account

After giving your TIN and password, it will take you to your account. After taking it, you will see some options on the left side. Among these options is an option called return submission.

You have to click this option. After clicking here, you will see that a page will appear where you will be asked to provide a lot of information.

Here you have to give your assessment year, the year for which you want to pay your income tax return. After that, the information that will be asked to be given here must be filled in very well.

Then below, you will see an option called Save and Continue. You have to click this option.

Pay Your Online Tax Return

After clicking Save and Continue, you will be taken to a new page with additional information, which you must enter here. Fill in these details carefully and click on the save and continue buttons.

After clicking again, you will be taken to a new page where you will get a page called Income Details which will ask you to provide some more information.

You have to provide this information very well. Here you will see other than your monthly income, such as house rent allowance and medical allowance. If any of these allowances, you have to provide that information.

After providing these details, you have to click on the save button again, and you will be taken to a new page. You will be asked to provide detailed information regarding your salary on that page.

Here you have to give the information very well and press the save and continue buttons. After that, you will be taken to a new page, and a page will appear where your given information will show.

The next page is called Assets and Liabilities. You will be asked to provide information about your assets on that page.

Here you need to provide information about the resources you have. Here are some resource names. To the left of these assets, you have to mark the ones you have, and if you don’t have them, then don’t mark them.

On the next page, you will see your tax and payment page. Here you need to mention some details of your payment. Here you will be informed about your total income, other assets you have, and the total tax on them and you will have to pay on this page.

Here you have to pay a certain amount of tax on a certain income which will be mentioned here. You have to pay that fixed amount of tax here either way.

On this page, you will see an option named ”Pay Now”. By clicking on this pay now option, you can complete the payment here by bank credit card or any other method, and at the end, you will see an option called to submit the return. Clicking this option will complete your return payment process.

Last Words About Online Tax Return BD

Filing taxes officially is a cumbersome and time-consuming process in our country. For many people, it is also a complicated process. The government has introduced an online tax return system to make it easier for people to file taxes.

The online tax return system is still in its infancy, and many kinks must be worked out. However, it is a step in the right direction and will hopefully make filing taxes much easier for everyone.

And I hope you got to know correctly how to make online return submissions. Today’s discussion can help you specifically in this regard and give you reliable guidance to complete your tax return submission at home.