Any sole proprietorship or joint-proprietorship-based business requires VAT registration. If he does not register for VAT, he faces various obstacles from the government.

According to government rules and regulations, VAT registration must be done at the beginning of the business, whether a sole proprietorship or joint proprietorship.

You need to keep a few things in mind for VAT registration. Some of them are mentioned in today’s discussion.

What Is VAT Registration In Bangladesh?

In Bangladesh, businesses with an annual turnover of at least 30 lakh taka must register for Value Added Tax (VAT). The registration process can be completed online through the National Board of Revenue (NBR) website or by visiting a local VAT office.

Businesses must submit various documents, including their Taxpayer Identification Number (TIN), trade license, and bank statement. Once registered, businesses must file regular VAT returns and pay the VAT collected from their customers to the government. Failure to register for VAT or comply with VAT regulations can result in penalties and fines.

VAT registration or Business Identification Number (BIN) is mandatory for almost all manufacturing and service businesses.

If you have such a business, you must do registration, but how registration is usually done is you can do it in an office, including the officers’ office. Today we will discuss how you can register your Business Identification Number online at home.

Documents Required for VAT Registration

If you want to register online, then you need some necessary documents. All these documents must be submitted to the office after online VAT registration. They are-

- E-TIN

- National Identity Card

- Trade license

- Bank Account Certificate

Online VAT Registration Process In Bangladesh

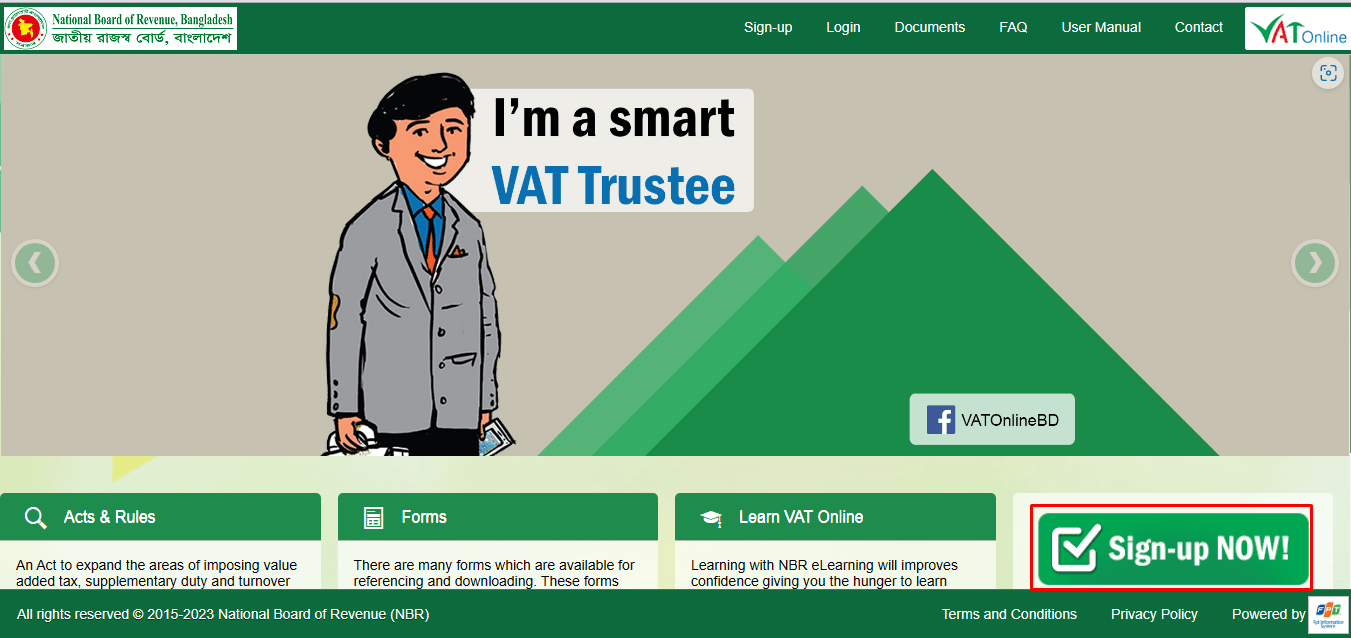

Now let’s go to the main point. Here we will know how you can register online. First, you open any browser from your computer or laptop and go to www.vat.gov.bd website.

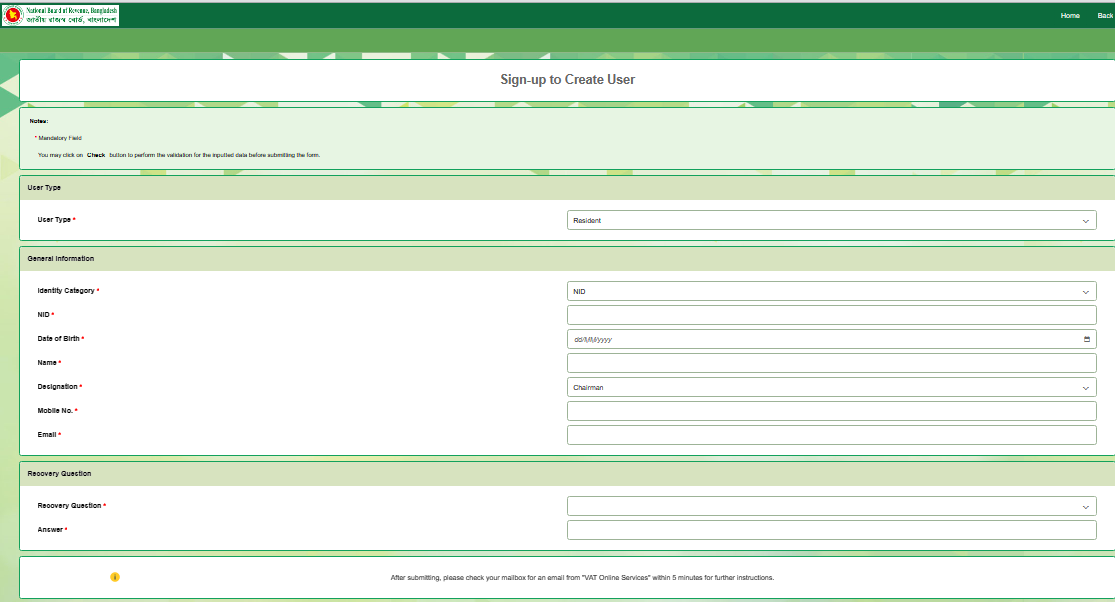

- Here you have to sign-Up first. Sign-up is your introduction to the VAT online system. Create an account by providing all your correct information.

- All work, including VAT registration and submission of documents, will be done with this account.

- Here you will get a User ID and Password to enter the system. One thing to note at the time of sign-up is to select Register as Taxpayer (Headquarters) to register an organization.

- After registering the branch under Central Registration, you must sign up by selecting Register as Taxpayer while working there.

- On the other hand, any staff should be signed up as Register as Taxpayer’s Employee to work.

- After providing the data in the sign-up form, press the Check button. If there is any mistake, correct it by following the instructions and press submit button.

- You will receive an email regarding this. Login to www.vat.gov.bd website by following the email instructions. Change the password as per the instructions during the first login.

- Select Mushak 2.1 Form from Forms for VAT Registration and note the first cell of the Mushak-2.1 form shows your TIN, and the second cell shows your name as present in the TIN certificate.

- This name is your name. Enter the other information in the Musak-2.1 form and press the Check button first in step 3. If there is any mistake, correct it by following the instructions and press submit button.

- Follow the instructions given here. A certificate is generated in the Musak-2.3 form containing a 9-digit Business Identification Number (BIN) in your name. It will also go to your e-mail. This Business Identification Number (BIN) created in your name is a Master BIN. You do not need to pay taxes or submit documents for a BIN.

- Now fill out the Musak-2.2 form to get a BIN in your business name. Enter your organization name here. Your new branch BIN and certificate will be generated in this name. In this name, you must pay taxes, keep accounts and submit filings.

- If you have more than one business in multiple names, get separate BIN for each of them in the same manner by filling up Form-2.2. All have to be taxed and filed.

After completing all tasks, you have to go to the VAT registration office along with the online application form and required documents given above. Then they will receive your documents and take some days to give you a VAT certificate.

So, this is all about VAT registration in Bangladesh. If you have difficulty understanding this article, let us know through the comment below. Thank you for being with us. Stay with us regularly to get all updated information.