Sanchayapatra Tax Certificate is a document that shows the amount of Tax Deducted at Source (TDS) on interest earned from Sanchayapatra in Bangladesh. Sanchayapatra is used for savings certificates that Bangladesh’s National Savings Directorate (NSD) issued.

Sanchayapatra Tax Certificate is now capable of being checked in online. The customer will no longer have to go physically to the bank or somewhere else; instead, the Sanchayapatra Tax Certificate will be sent to the customer’s email address easily.

As per the Income Tax Ordinance of Bangladesh, any interest earned from Sanchayapatra is subject to TDS. The rate of TDS varies depending on the type of savings certificate and the amount of interest earned.

Different Types Of Sanchaypatra Certificates

The National Savings Directorate Bangladesh issues various types of Sanchapatra. Sanchaypatra can be purchased by Bangladeshi citizens aged 18 years and above, women, Physically challenged men and women, and 65 years and above men and women can also buy sanchaypatra.

At present, there are four types of Sanchaypatra in Bangladesh. They are:

- Family Sanchaypatra.

- Three-Year Bangladesh Sanchaypatra,

- Pension Sanchaypatra and

- Five-Year Term Sanchaypatra.

Family Sanchaypatra

This savings certificate is designed for families with a minimum investment of 1,000 Taka. The certificate can be purchased jointly by two or more family members. The interest rate for this certificate is fixed and paid annually.

Three-Year Bangladesh Sanchaypatra

This is a medium-term savings paper with a tenure of three years. The interest rate for this certificate is fixed and paid annually.

Pensioner Sanchaypatra

This savings certificate is designed for retired individuals with a minimum investment of 5,000 Taka. The certificate has a tenure of five years, and the interest rate is fixed and paid quarterly.

Five-Year Bangladesh Sanchaypatra

This is a long-term savings paper with a tenure of five years. The interest rate for this certificate is fixed and paid annually.

The profit of Sanchaypatra is paid every three months. Profits on Savings Papers are being offered; they are proposed to be paid monthly and Sent to the Internal Resources Department of the Ministry of Finance Department of Sanchaypatra.

Interest rates for each type of savings bond are subject to change, and investors can visit the NSD website for the latest rates. Interest earned on savings bonds is taxable, and investors can get tax certificates from NSD.

Bangladesh Bank Sanchayapatra Tax Certificate Online

While filing income tax returns, a Sanchayapatra customer had to visit the bank or National Savings Directorate in person to get his tax certificate. Still, now it is possible to do it at home. Bangladesh Bank has developed automated software to send tax certificates to Sanchayapatra customers’ email addresses.

The Sanchayapatra tax certificate will easily be sent to the customer’s e-mail address used in the form when purchasing the Sanchayapatra.

For this purpose, the Information Systems Development and Support Department of Bangladesh Bank has developed BB Sanchayapatra Portal software. The Financial Institutions Department (FID) has directed Bangladesh Bank to issue tax certificates online to ease the suffering of savings card buyers. Because of this, the central bank has developed this software.

You must go to BB Sanchayapatra Portal and email them asking for a savings tax certificate. They will send your certificate to their return email within a few hours of receiving the email.

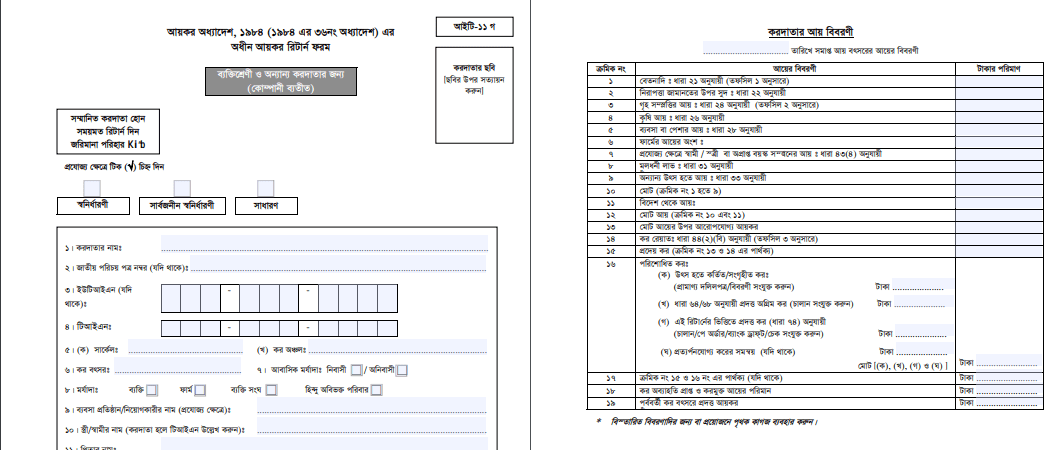

Sanchayapatra Tax Return Form

Many people Obtain TIN (Tax Identification Number-TIN) for various purposes, whether necessary or unnecessary, but never file a tax return. They generate a TIN certificate for savings but don’t know what it is used for.

The Income Tax Guidelines 2021-22 clearly state that if you have a 12-digit TIN certificate, you must and must file an Income Tax Return. Now the question is, what is the income tax return?

A statement of your income, expenditure, income, and assets for a year is to be submitted every year to the office of your concerned Sub-Tax Commissioner in a prescribed form called Income Tax Return.

Those who want to buy Rs 5 lakh Sanchayapatra simultaneously must have TIN in advance. Those who have TIN must go to the bank and buy the Sanchayapatra before filing the return. Banks do not sell Sanchayapatra without proof of filing returns or receipts.

Institutions that sell Sanchayapatra without receipt of returns will be fined up to Tk 10 lakh. So the bank will not sell Sanchayapatra without filing returns.

Receipt of income tax return or certificate from online NBR mentioning taxpayer’s name, TIN, and tax year or certificate from Deputy Commissioner of Tax will be accepted as proof.

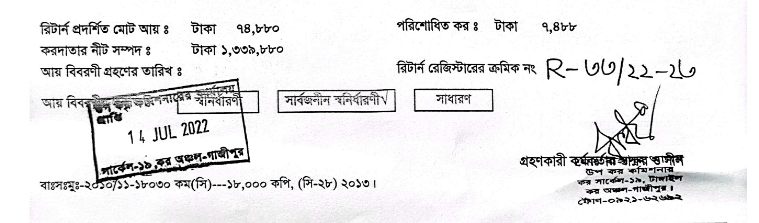

Sanchayapatra Interest Certificate as on 30.06.203

How can i get Sanchaya Patra Certificate?

Subject : Application to get the statement for the fiscal year 2021 to 2022 ( July’

Dear Sir,

I purchased a ‘Three Month Saynchaypatra’ on 29 June’2020 & 11 May’2021. ineed to get the statement its posible to get from by email ???

Thanks

Jahangir