Simmons First, a regional bank serving Arkansas, Missouri, and Kansas, offers exceptional financial services to individuals and commercial entities.

Their suite of credit cards includes four Visa options: Visa Platinum, Visa Platinum Travel Rewards, Visa Classic, and Visa Gold Select. These credit cards come with impressively low-interest rates, catering exclusively to individuals with excellent credit ratings.

Simmons First Credit Card Information

Simmons First, a regional bank serving Arkansas, Missouri, and Kansas, stands out for its exceptional financial services tailored to individuals and commercial entities.

Among its offerings, Simmons First presents a suite of uncomplicated credit cards suitable for various needs. They provide four Visa options- Visa Platinum, Visa Platinum Travel Rewards, Visa Classic, and Visa Gold Select.

These credit cards boast impressively low-interest rates, ensuring they are exclusively accessible to individuals with excellent credit ratings.

For those seeking simplicity and flexibility, the Visa Classic and Visa Gold cards are enticing, featuring an attractive APR of 10.25%.

For individuals prioritizing a minimal interest rate for purchases and balance transfers, the Visa Platinum card offers the most competitive rate at 7.25%.

On the other hand, if you value rewards over the lowest possible rate, the Visa Platinum Travel Rewards card might be your preferred choice.

With an APR of 9.25%, this card offers an appealing rewards program with ample travel rewards and merchandise options. Discover more about the available rewards by visiting the Simmons First Rewards website.

Simmons First credit cards have earned commendations for their fair terms and conditions, low penalty APRs, and minimal transfer fees.

If you possess a favorable credit score and are searching for a straightforward yet rewarding credit card, exploring the offerings provided by Simmons First would be highly advantageous.

Simmons First Credit Card Features

Simmons First Credit Card has several attractive features designed to provide convenience and flexibility to cardholders. Here are some noteworthy features-

Low-Interest Rates and Fees: Simmons First Credit Card offers competitive interest rates, allowing you to save on finance charges when carrying a balance. The credit card has minimal annual fees, helping you keep your costs in check.

Rewards Program: The credit card has a reward program that enables you to earn points or cashback on your purchases. You can accumulate rewards and redeem them for various options like travel, merchandise, or statement credits, providing extra value for your spending.

Online and Mobile Banking: Simmons First Credit Card offers robust online and mobile banking services, allowing you to manage your account from anywhere conveniently. You can check your balance, view transactions, make payments, and set up account alerts through the online portal or mobile app.

Security Features: The credit card prioritizes your security with advanced features such as fraud monitoring and zero liability protection. With these measures in place, you can feel confident using your Simmons First Credit Card for online and in-person transactions.

Balance Transfers: If you have balances on other high-interest credit cards, Simmons First Credit Card enables you to transfer those balances to your new card at a low or zero percent introductory APR. This feature can help you save on interest payments and consolidate your debt.

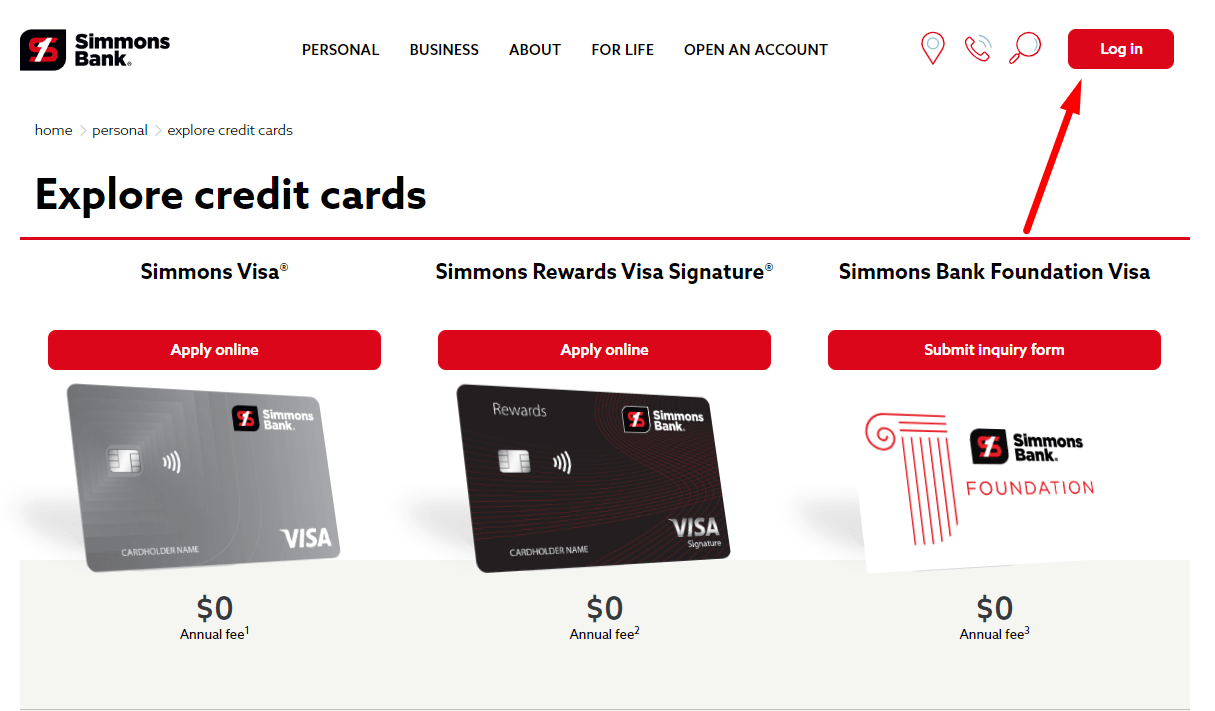

Simmons Credit Card Login Process

Once you receive your Simmons First Credit Card, you can set up an online account for convenient access and management. Follow these steps to log in to your account below-

- Visit the Simmons First Credit Card website.

- Press the login section on the homepage.

- Enter your username and password to access your account.

If you haven’t created an online account yet, click on this page’s Open An Account option.

Follow the instructions to create a username, password, and security questions for your account.

Once you have successfully logged in, you can explore the various features offered by the online platform, such as viewing your balance, checking recent transactions, making payments, and updating your account information.

Simmons First Credit Card Payments System

When it comes to paying your Simmons First credit card bills, you have a variety of convenient options to choose from. Whether you prefer traditional methods or the ease of online banking, Simmons First offers flexibility to suit your payment preferences.

- Mail Payments

If you prefer to make payments by mail, you can send your payment to the following address-

- Bank Card Processing, PO Box 84071, Columbus, GA 31908-4071.

Mailing your payment near the due date may result in delays, so send it at least 5 business days before the due date indicated on your monthly billing statement.

Simmons First provides a priority/overnight mail service for a faster delivery option. You can send your payment to-

- Simmons First Payment Processing, 1030 5th Avenue, Columbus, GA 31901.

Remember to include your Simmons First account number on your check, which can be found on your statement.

- Phone Payments

Simmons First offers a convenient phone payment service for its credit card customers. You can make payments by calling (800) 272-2102. Automated payment service is available free of charge. However, if you choose to speak with a customer service representative for assistance, a $12 fee will apply.

- Online Banking

Registering for Simmons First’s online banking service is highly recommended as it provides comprehensive management options for your credit card.

By accessing your account online, you can view your transaction history, transfer funds from your accounts to pay your credit card balance and utilize online support whenever you need assistance.

To make a payment online, log in to your online banking account and follow the prompts. Payments made online or via phone before 5:00 PM EST will be credited to your account on the same day.

- In-Store Payments

Simmons First allows you to make credit card payments in any Simmons First Bank branch. Visit your nearest branch location and inform the bank representative that you want to pay towards your Simmons First credit card.

By offering various payment options, including mail, phone, online banking, and in-store payments, Simmons First ensures that you have the flexibility and convenience to manage your credit card payments in a way that suits your preferences.

FAQs

- How long does it take to get approved for a Simmons First Credit Card?

Ans: The approval process for a Simmons First Credit Card can vary depending on various factors. You should receive a decision within a few business days after submitting your application.

- Can I use my Simmons First Credit Card internationally?

Ans: You can use your Simmons First Credit Card for international transactions.

- What should I do if I forget my login credentials?

Ans: If you forget your Simmons First Credit Card login credentials, you can follow the password recovery process provided on the credit card’s website. This usually involves verifying your identity through security questions or receiving a password reset link via email.

- Are there any annual fees associated with the credit card?

Ans: Simmons First Credit Card offers competitive annual fees; some cards may even have no annual fees. Reviewing the terms and conditions of the specific card you choose is important to understand any associated fees.

Conclusion

Simmons First Credit Card provides a range of features and benefits that can enhance your financial flexibility and convenience. By understanding the card’s features, managing it wisely, and leveraging the rewards program, you can make the most of your credit card experience.