Follow today’s discussion carefully to learn details about Bangladesh Custom Duty Payment and clear all confusion about Custom Duty e-Payment. I hope you get all the ideas about Bangladesh Custom Duty Payment from today’s discussion.

So let’s know how to make Bangladesh custom duty payment, where to make it, and more detailed information about it.

Custom Duty e-Payment In Bangladesh

First, we need to know what is custom duty payment. We need to know about custom duty before paying custom duty. When we stay in the country and purchase foreign goods, and when the goods are imported from abroad, we have to pay some extra duty.

It is prescribed by the Government of Bangladesh that a fixed rate of customs shall be levied on foreign goods and collected accordingly.

This is custom duty. But we don’t know how we will calculate the customs duty, where we will deposit it, and the exact percentage of customs duty to be paid on certain items. That is also unknown to many of us. Let’s know about it in detail from the discussion below.

Rate of Custom Duty

First, let’s talk about custom duty payment rates. The rate is how much you pay for something. It usually has no fixed amount. We have to calculate it as a percentage.

Suppose you buy a television from abroad, and when it arrives in the country, it is essential to know the duty rate you will have to pay for this television.

Then you can calculate how much money you have to pay and your idea about this will be apparent to a large extent. Custom duty is levied at different rates on different products.

It is not only levied at a fixed rate. Custom duty will be collected from you according to the type of goods you purchase. First, we need to know about the custom duty payment rate.

Not knowing the custom duty payment rate correctly can lead to miscalculations and huge losses. You need to know about the custom duty payment rate and how to calculate it. Let us know the customs duty payment rate and how to calculate it below.

Custom Duty Calculation

Now let’s know the customs duty payment rate besides knowing about custom duty payment calculation.

If you buy any goods from abroad, you must visit the official website of Bangladesh Custom Duty to know how much duty you have to pay on these goods. It is essential to know that different items are subject to different duty rates.

If you buy a television, the percentage of duty charged on the TV will be levied on other items but not at the same rate. Duty is levied at different rates on different goods.

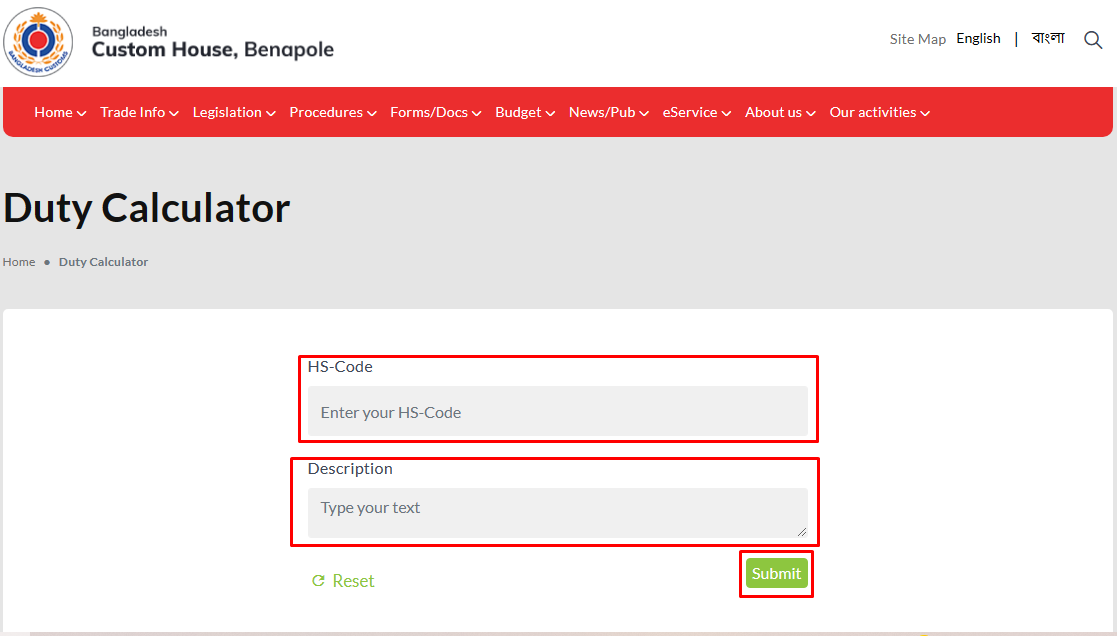

To know about this, click on the website given below. By visiting this website, you can calculate custom duty payment and get the exact percentage of duty you will have to pay on any item very quickly.

Here you will get two options. The first is the HS code. That is the code number of any product abroad. You must fill in the description box if you get more than one HS code on the product.

You have to with the product type in the description box. And finally, press the submit button. Then all kinds of this product’s custom duty rates will be shown.

How to Return Custom Duty

From the above discussion, you know about the custom duty payment rate and calculation of custom duty payment. But how and where do you pay custom duty? This is very important to know.

First, you don’t have to worry about customs duty payment because custom duty payment is straightforward. You don’t have to visit any office to pay for it.

When you import a product from abroad, and it will be delivered to you when it arrives in the country, then when the delivery boy comes to give it to you, you have to explain the customs duty payment to the delivery boy.

Or in many cases, the products arrive at our post office. Then we must go to the post office, pay the customs duty there, and bring our goods.

So don’t worry about how to make customs duty payments. When the goods reach you, you will make the custom duty payment at the place where the goods will be delivered at the time of collection. Then you are done.

So this is today’s discussion about custom duty payment. I hope you have learned all the information about custom duty payment from today’s debate. Please visit our website for any information related to customs duty payment or any tax or VAT. Thank you.