Get the correct and straightforward rules on how to pay the holding tax online here. So follow this article till the end to know the online holding tax payment system.

By holding tax, we mean property tax. Usually, a certain amount of tax is levied on our property or house at a particular time of the year. It has to be paid online or by visiting the tax office.

Today it is tough to go to the office and pay income or holding tax. Because it causes a lot of trouble, we can pay to hold tax online if we want. Let’s know how we can make the holding tax payment online.

How to Pay Holding Tax?

Before paying holding tax, you need to know about holding tax in detail. What is holding tax, how to calculate it, and how much do you have to pay on the property or house? You need to know all the rules, calculations, and calculation rules.

If you know these things, then it is ok. And if you don’t know, you can go to the following article to learn more about holding tax.

Here are the details of what holding tax is, how much-holding tax can be calculated based on the size of the house, and how to calculate it if you want to know about holding tax in detail from the below article.

Holding Tax Details

Now we will discuss how to make holding tax payments online. To make holding tax payments online, you need a computer, laptop, or smartphone and an internet connection.

Then you can quickly pay the holding tax with your holding number with the help of a single link. Let’s find out.

Holding Tax Payment Online

Now let’s go to the main discussion. We can make the holding tax payment in two ways. One is to go directly to the office, and we can submit it.

Another is that we can do the work online very easily from home. We will know how to pay the holding tax online quickly. Follow the below steps carefully to know them.

To make the holding tax payment online, open any browser from your computer, laptop, or mobile and enter the following link.

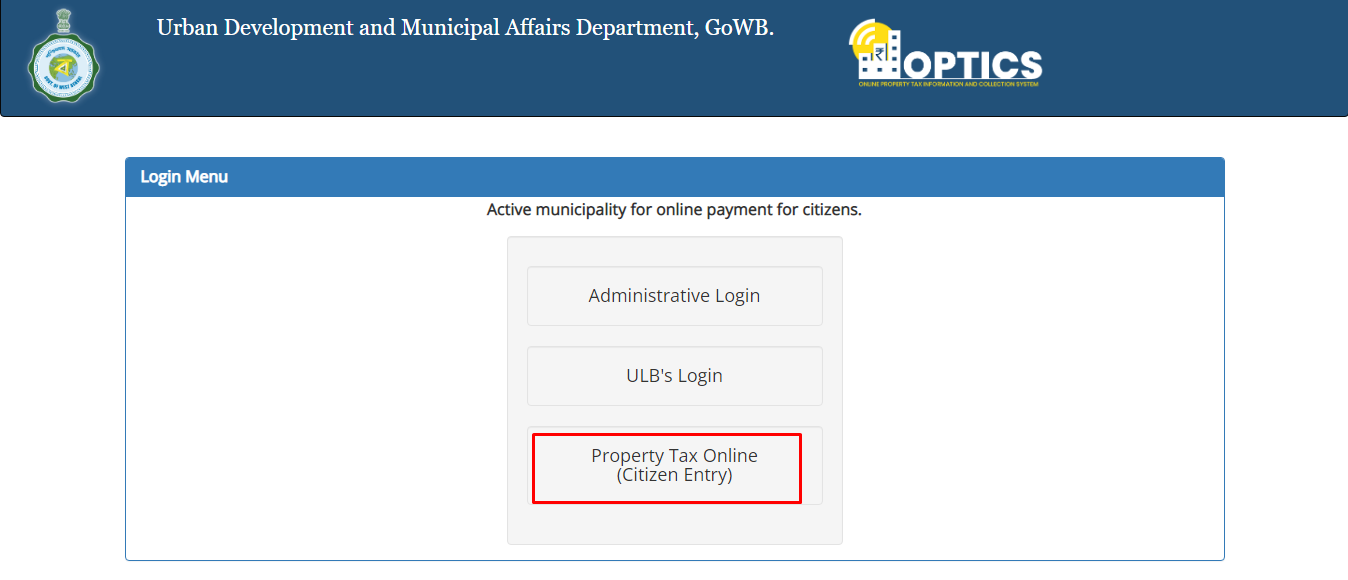

After entering this link, you will see a page like the below image.

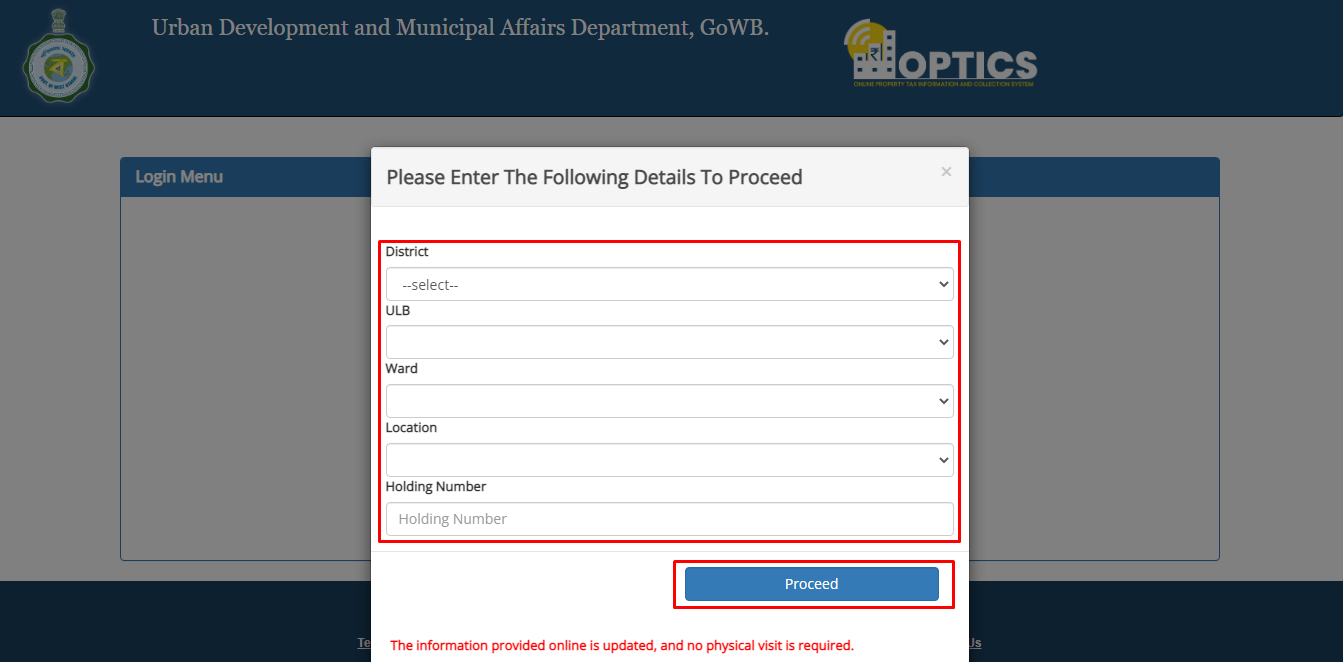

Here basically, three options will show. Among these three options, you have to click on the option below the Property Tax Online. A popup window will appear as soon as you click on this option. Here you need to enter some information.

Among these options, first, you have to select District. It would help if you mentioned which district you live in according to your address.

The next option is ULB. It is the name of your municipality, municipal or union council should be mentioned here.

There is an option under Ward. You have to mention the ward number you are staying in here.

The next option is the Location

After giving the above information, clicking on the location button will bring up the options of which location you are located. You have to select your exact location here.

The last option is holding the number. Here you have to enter the holding number. You have to write the holding number of your house here.

Then click on the Proceed button. Then your information will be finished.

After that, a new interface will appear in front of you. It will show all your properties and your total tax due, which means your holding tax will also show here. And at the bottom, you will see the pending payment status. Here you have to select the payment method.

By which method will you pay your tax – through a bank account or a credit card? You have to select it here.

So you will be asked for information about your account after selecting which method you want to pay tax. By clicking the submit button with that information, your fixed amount will be deducted from your account, and your holding tax payment will be completed.

A new form will appear after the tax payment is completed. It will contain all your tax-related information, and you will be asked to print it. Be sure to print a copy of it for later reference.

This is today’s discussion. We hope that you have solved the holding tax problems and know the payment method from today’s discussion.

If you have difficulty making tax payments, you can inform us through the comment box. Our team will try to help you as much as possible. You can visit our website to get such online-based services. Thank you.

I am searching online payment system of E-holding tax of BD but i have found Indian site?

Can I pay holding tax through bkash?