You will need two main things to open a new Bkash account. One is the mobile number, and the other is the original copy of the National Identity Card. Once the Bkash account is opened, some time is taken to verify the information in the KYC form.

Once your KYC form information is verified, within 3-5 days, you can enjoy cash out, mobile recharge, payment, and other services of Bkash. After your account is fully activated, you can access the development service 24 hours a day, seven days a week, by dialing *247#.

Bkash Account Open Is Easy Now!

Once upon a time, sending money instantly while sitting at home was unimaginable. Banks were the only banks used to exchange money between countries. But Bkash has solved that human problem. Now people can transfer money to their loved ones instantly without any hassle.

Therefore, Bkash, in the field of money transactions, has become the only focus of our hope and trust. Bkash is an application or a mobile banking system through which its customers can receive various benefits, including money transactions at any time.

Below are the rules for opening a Bkash account. Nowadays Bkash account is used by almost all age groups, including students. Below is the complete process of how to open a new Bkash account.

Documents Required for Opening a Bkash Account

Before you open a Bkash account, you need to collect some documents. You can open a Bkash account through the app if you have all these documents. The documents which are applicable for opening a Bkash account are-

- Photocopy of National Identity Card

- Two copies of passport-size color photographs

But you won’t need a photocopy to open a Bkash account through the app. While opening the version with the Bkash app, you must take a photo of them from your phone.

How to Open Bkash Account?

Bkash in money transactions has become the sole focus of our hope and trust. Bkash is an application or a mobile banking system through which its customers can receive various benefits, including money transactions at any time.

A new Bkash account can be opened basically in two ways. One is online through the Bkash app, and the other is through the Bkash agent. You can create a Bkash account by installing the Bkash app at home. And if you don’t want these problems, you can go to any agent near you and open your Bkash account. Both methods are discussed below.

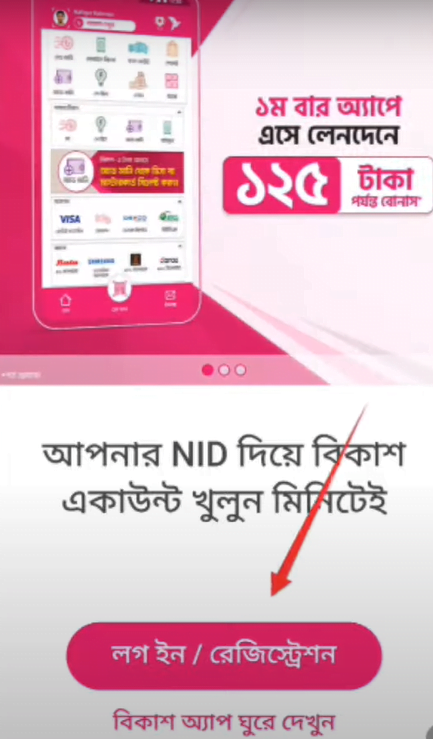

Bkash Account Open Online Using Bkash App

First, let’s discuss how you can open a Bkash account online. Here will show how to open a Bkash account online through the Bkash app. To open a Bkash account online, follow the below-mentioned procedures very well.

- To open a Bkash account online through the Bkash app, download the Bkash app from your phone to the Play Store.

- After installing the Bkash app, open it.

- After opening, it will ask for registration here.

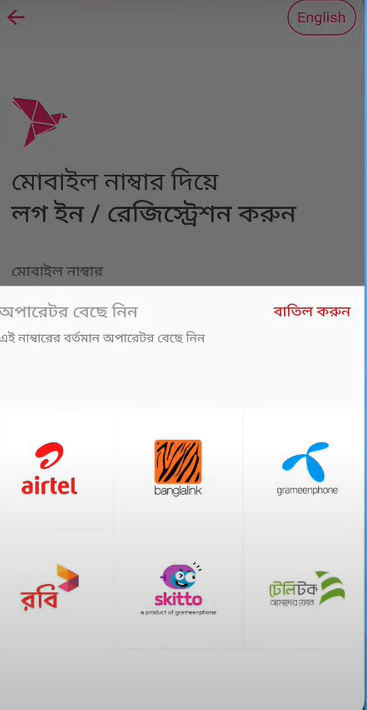

- Go to the register option and enter the number you want to open the Bkash account.

- Then you have to select your operator.

- You have to select the language option by choosing the operator’s SIM number you are using.

- The next step is to take a good photo of both sides of your National Identity Card.

- After giving the photo of your national identity card, all your information will be filled in from BKash.

- Next, you need to provide more information like gender, occupation, source of income, etc.

- Once this information is given, you have to upload a picture here.

- So here, capture a picture of you well in perfect light, select it at the specified location, and confirm the Bkash account opening process.

- As soon as you confirm, a confirmation SMS will be sent to your phone from Bkash.

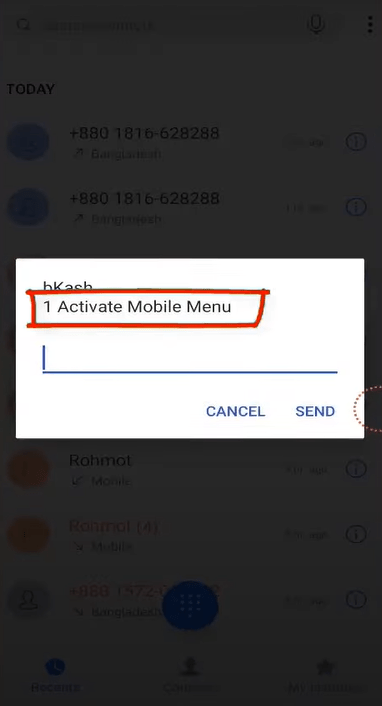

- Next, dial *247# from your phone. Here you will get the option to set up a PIN by dialing.

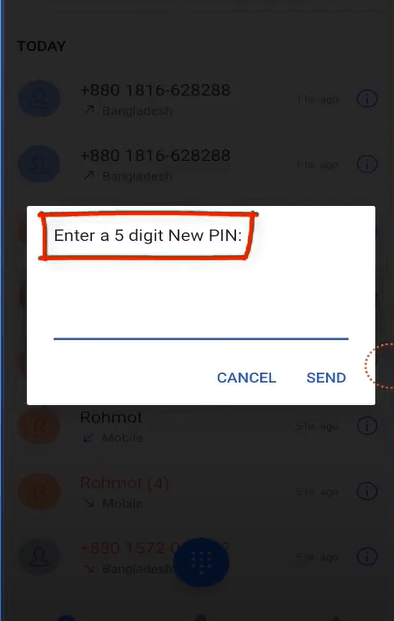

- Complete your account opening process by setting a five-digit PIN.

Then your Bkash account will be ready for use.

Rules for Opening a Bkash Account Through An Agent

If you do not understand the above online procedure or do not go through these problems, you can visit your nearest agent to open your Bkash account. You will need two things to open a Bkash account with an agent. They are a photocopy of your National Identity Card and two copies of your passport-size photographs.

Contact your nearest agent with these two documents and inform them about opening your Bkash account. In this case, they will accept your information and quickly open a Bkash account. Once the Bkash account is opened, a confirmation SMS will be sent to your phone.

Then you can set a PIN by dialing *247# from your phone. After that, once Bkash accepts your KYC form, you can make money through this Bkash account.

How to Open Bkash Account Without NID Card

Many people ask how to open a Bkash account without a NID card. A NID card is required to open a BKash account. But if those who do not have a NID card and those who are below 18 years of age want to open a Bkash account, how can they open a Bkash account without a NID card?

Let’s discuss that at this point. If you don’t have a NID card and are going to open a Bkash account, you cannot open a Bkash account through the app. If you have a birth registration, you must go to your Bkash agent with a photocopy of the certificate.

So go to your Bkash agent with your photograph and birth registration. In this case, they can open an account by filling in your details.

How to Open Bkash Account With a Passport

For people who have lost their NID card or birth registration certificate or do not have it, many people ask whether they can open a Bkash account with their passport. The first thing required to open a Bkash account is the NID card.

You can open a Bkash account anytime, anywhere, with a NID card. But if you don’t have a NID card and it becomes essential to open a BKash account, you can contact your nearest BKash agent with your passport photocopy and two passport-size photocopies.

In this case, they will explain to you how to open a Bkash account with the help of a passport. They can help you in opening a Bkash account.

Bkash Transaction Limit

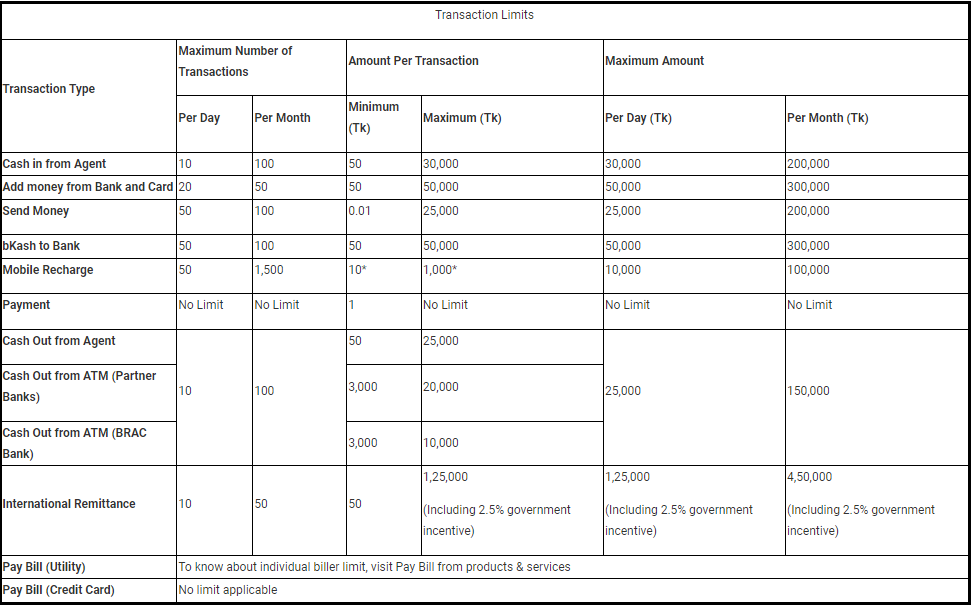

We learned about the procedure for opening a Bkash account. But after opening the Bkash account, knowing the maximum number of times and up to which amount of Bkash money we can transact in this account in a day and month is also a matter.

- With a Bkash account, you can cash in up to 10 times a day and up to 100 times a month.

- You can cash in your Bkash account from a minimum of 50 to a maximum of 30,000 per day and 200,000 per month.

- On the other hand, in case of cash out, you can cash out a maximum of 10 times a day and 100 times a month.

- n terms of cash out, you can cash out from a minimum of 50 TK to a maximum of 25,000 TK per day and 150,000 per month.

You can see everything from the table below about the Bkash transaction limit.

So, this is the whole process of opening your bank account quickly at home using the Bkash app. Remember this, do not share your Bkash PIN with others. Please keep it safe and secure, and enjoy your Bkash mobile banking.

Want to create account