Online land tax payment is quite an easy and hassle-free way to pay land tax from home. The land development tax is a state important tax in Bangladesh. The land development tax was previously paid through the office, but now the government has introduced the system of taking the land development tax online.

Ministry of Lands took initiatives to reduce harassment of people, stop irregularities, and corruption, and bring transparency in government revenue collection.

The Ministry of Land has developed an application for paying land development tax through which citizens can pay land development tax online at home.

Land Development Tax in Bangladesh

Land development tax is a state tax in Bangladesh where land owners are required to pay the tax. And in order to eliminate the corruption, irregularities, and harassment of this land development tax.

The government has already launched online land development tax registration and through this, any land owner can pay land development tax online. For this, every land owner has to be registered and can pay tax using user name and password.

Online Land Tax Payment

Online Land Development Tax or Rent Receipt can now be collected easily from your mobile phone. Many of us feel that when we go to submit rent or land development tax online, the Union land office overcharges or harasses us.

Considering that direction, Bangladesh Land Development Board brought the facility of online land development tax submission.

So from now, you can easily pay your rent from your mobile or any Bkash point without going to the office. Today I will tell you about that in detail.

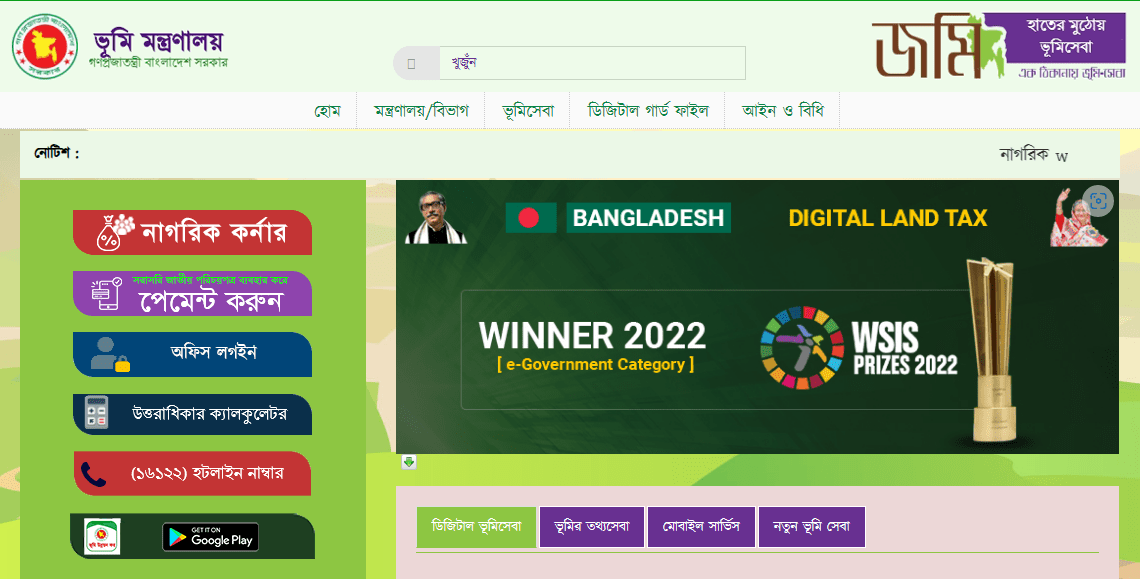

- First, click in this link to pay land development tax online.

- After clicking on this link you will enter the website of the Bangladesh Land Development Tax Department.

- From here you will see a button named নাগরিক কর্নার/Citizen Corner on the left side. Press this button.

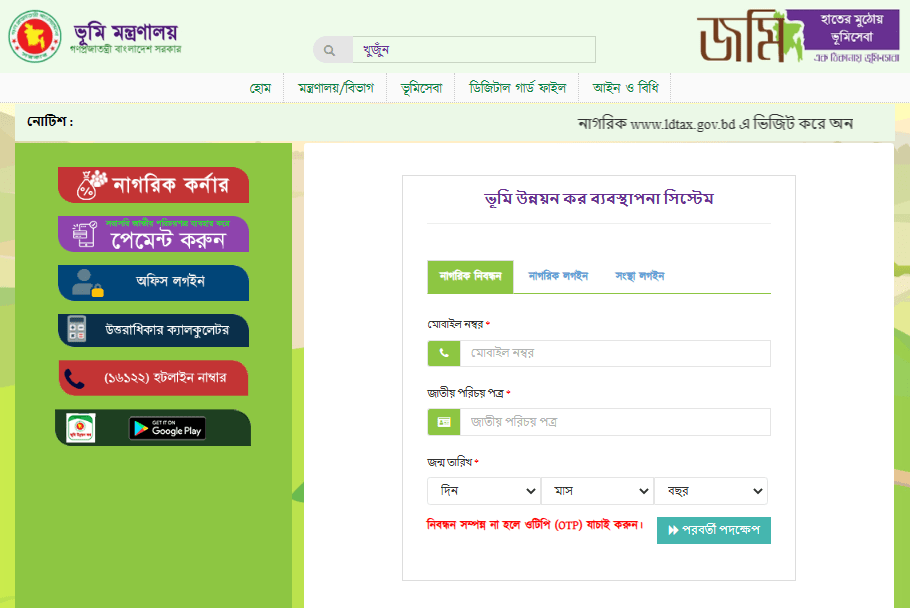

- After pressing this button you need to create an account for Land Development Tax Parishad. Later you can pay this tax in this account.

- To register here you need to enter your mobile number, national identity card, and date of birth correctly. Then press the next button.

- Press the next button and your page will reload and your information will appear with your name and picture.

- If your name and details are correct here then press the next button again.

- Then on the next page, an OTP will be sent for your mobile number verification.

- Enter that copy correctly here.

- After entering the OTP, press the next button.

- Then if you want to solve your various tasks with this account later, here you have to create a password.

- You can access this account later with this password.

So you have to complete your registration process here with a password of your choice.

After completing the registration with the password, click on the next button and a dashboard will appear in front of you where everything including your profile will be mentioned.

- From here you can check all the information including your profile.

- Now go to your profile dashboard and enter your division district upazila Mauza, and Holding numbers correctly. Because you will definitely need this information in case of land development council. So, edit this information in your profile.

- All your records and holdings must be properly entered here.

- Once the verification is done you will be shown your land information. And it will show how much tax has come along with the arrears.

Online Land Tax Payment Process

After doing this, if you click on the Pay option below, a list of the methods you want to pay will be displayed. So select the mode from which you will deposit money. You can also pay through Bkash, Rocket, or other banking services from here.

- To do this, you must select a specific method and pay by providing its information.

- Then your tax will be paid.

- Now you can deposit money according to the rest of your rules.

- The authority through which you make the payment will give you a voucher with your transaction number on it.

- And with this transaction number, you can collect your receipt from the Union Land Office at any time.

Land Development Tax Rate

Now let’s know how much TK should be paid for the land that you have. The tax rate depends on some factors. All about the tax rate is given below.

- From 1987, 3% paisa for 2 acres of land, not less than 1 tK in all.

- 30% paisa for land from 2 acres to 5 acres.

- 50% Paisa from 5 acres to 10 acres.

- All taxes were withdrawn from agricultural land up to 25 bighas or 8.25 acres.

- 231 TK for the first 10 acres from 10 acres to 15 acres and 60 Paisa for every percentage thereafter.

- 531TK for the first 15 acres from 15 acres to 25 acres and 60 Paisa for every percentage thereafter.

- If on 25 acres then 1481 TK for the first 25 acres and 1 TK 45 paisa for each percentage thereafter.

Land Development Tax Payment Method

If land development tax is arrears for 1 year, the said tax will be deemed due after the 30th quarter of the concerned Bengali year and interest at the rate of 6.25 will be added to the principal tax owed and the interest will be higher for the year the tax is outstanding and will be added to the principal tax.

If an agricultural land owner has to pay a land development tax of Tk 100 per year and it is in arrears for some years, there should be calculated the present tax.

If any person has arrears for some years, then he should calculate it according to the method below. Just think, a person has 6 years of arrears and his principal tax is 100 TK. then-

- Principal tax is 100 x 6 = 600 TK

- Interest for the 5th year will be = (100 x 6.25% x 1) = 6.25.

- Interest for 4th year will be = (100 x 6.25% x 2) = 12.50.

- Interest for 3rd year will be = (100 x 6.25% x 3) = 18.75.

- Interest for 2nd year will be = (100 x 6.25% x 4) = 25.

- Interest for 1st year will be = (100 x 6.25% x 5) = 31.25.

- So for 6 years total (600+6.25+12.50+18.75+25+31.25)= 693.75 TK outstanding land development tax has to be paid.

In which Cases Land Tax is Not Applicable

In some cases, land development tax is not applicable. But to tax-free the land, the owner or organization should be applied to the commissioner of the district. Let’s know about the factors below.

- If the land is less than 25 bighas then tax will not be required.

- If any land is used as a poultry farm/dairy farm by manual labor at the small and marginal farmer level.

- Less than 5 handlooms are run by the land owner himself by manual labor.

- The District Commissioner can waive land development tax for mosques, Eidgahs, temples, churches, pagodas, graveyards, and cremation grounds. For this, you have to apply to him.

Rules for Online Fee Payment

You can pay land development tax online. For this, you don’t have to use any other link or any other method. When you go to the online land development website and enter all the details related to your land, the amount of tax you will have to pay will be mentioned.

- Here your payment options will appear.

- Here you can select the mobile banking option.

- After selecting mobile banking, all these options will come here: Bkash, Nagad, Rocket, and Upay.

- From here you have to click on any option of your choice.

- After clicking the pay now button. Then you have to provide your account pin number here.

- After providing the PIN number, click on the Pay Now button and your payment will be completed.

- After the payment is completed here you will get some options.

- Here you will see that there is an option called Print Receipt.

- Click on this option to print your fee payment receipt.

- Then it will attach the challan online to you two days after paying the fee.

Land development is an important issue and it plays an important role in the economy and the real development of the country. Now all work is possible online so the land development process is also possible online.

If you want to carry out any work in the field of land, you can apply online by visiting the website of the government and district administration and collecting the necessary information. There are also various online services available that will help you gather information about your land.

জমির প্রকার জানালেন না, জমির পরিমান ২৫ বিঘার কম হলে ভূমি উন্নয়ন কর দেওয়া লাগবে না। একটু ব্যাখ্যা দিলে বাধিত হবো।