TIN certificate re-registration should be done every five years from the date of issuance. If you obtained your TIN certificate in January 2018, you must re-register it in January 2023.

You may also need to re-register your TIN certificate if there are any changes to your personal or business information, such as a change of address, change in ownership structure, or change in business activities.

TIN Certificate Re-Registration

TIN re-registration refers to updating and renewing a taxpayer’s Tax Identification Number certificate in Bangladesh. The TIN certificate is a unique 10-digit number assigned to taxpayers by the National Board of Revenue to identify them and track their tax payments.

The re-registration process involves submitting an application to the NBR online or in person, providing the necessary information and supporting documents, and waiting for approval. Once approved, the updated TIN certificate is issued to the taxpayer with a new validity period of five years.

Why is TIN Certificate Re-Registration Necessary?

Re-registration of the TIN certificate is required to ensure that the National Board of Revenue information about the taxpayer is accurate and up-to-date. Taxpayers must keep their TIN certificates and information current to avoid legal issues related to tax payments.

Re-registration of the TIN certificate is required every five years to ensure accurate information reflects changes in taxpayer circumstances. Information updated upon new registration includes personal, business, and tax-related information.

It is important to note that failure to re-register the TIN certificate may result in fines and penalties from the NBR. Problems can also arise when filing tax returns and claiming tax benefits. Therefore, it is important to ensure that TIN certificates are re-enrolled on time to avoid adverse effects.

When Should You Re-Register Your TIN Certificate?

According to the National Board of Revenue in Bangladesh, re-registration of the TIN certificate is required every five years. If you have a TIN certificate, you must re-register every 5 years to ensure your information is current and accurate.

Re-registration may be required even before the five-year expiration date. If your personal information, such as name, address, or contact information, changes, you should update your TIN certificate immediately. Similarly, if your business information, such as your name, ownership structure, type of business, etc., changes, you should update your TIN certificate promptly.

If you have registered your TIN but have not received it within a reasonable time, you should contact the NBR to inquire about the status of your application. If you have problems with your application, you may need to re-enroll your TIN certificate.

TIN Certificate Re-Registration Fee

We know we don’t have to pay any fee while doing TIN certificate registration. Also, we do not have to pay any fee for updating or re-registration of the TIN certificate. You can register online very easily. Below is the full process of how to do teen certificate re-registration online. I hope you check it out from there.

TIN Certificate Free Registration Form

Apart from online, you can re-register a TIN certificate offline. If you are unfamiliar with it online, download the TIN registration form, fill it out at home, and submit it to the nearest tax office.

Then they will save your filled application form in the online database and upload your TIN certificate. You can collect the TIM certificate registration form from the official website.

Download the E-TIN Re-Registration Form in the PDF now. You can also download the TIN certificate registration form from here and fill it out.

Documents Required for Re-Registration of TIN certificate

No such documents are required for the re-registration of the TIN certificate. If you do it online, then you don’t need any documents. But if you have done it by filling out the form offline, you must submit the following documents.

- A copy of your existing TIN certificate.

- Your national ID card or passport.

- A recent passport-size photograph and signature.

TIN Certificate Re-Registration Online Process

So far, we have known the basic information regarding TIN re-registration. Now check how you can re-register your TIN certificate online. Below we have mentioned each point step by step on how to get your certificate TIN re-registration.

- Click on this link to do TIN re-registration online.

- First, you need to log in by entering here.

- Log in with your user ID and password. If you don’t have an account, open an account by clicking on the registration button.

- Then set up your user ID and password. Then log in with that user id and password.

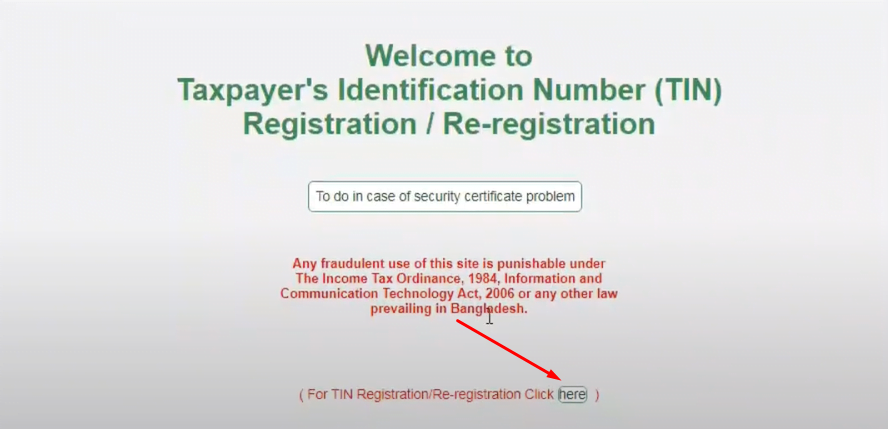

- After login, you will get a page like the below image.

- From here, you must click the click here button on the right side below for TIN registration.

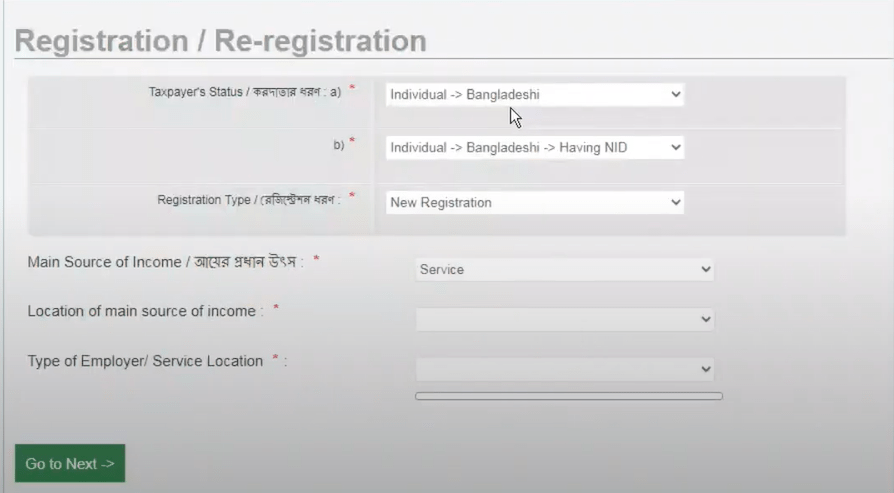

- After clicking here, a form will appear in front of you.

- First, you must take the Taxpayer’s Name, i.e., if you want to register, you must provide your name here.

- Then select Individual from the button below.

- Then below, you will see the registration type.

- Re-registration is required here as you want to re-register your TIN.

- Then below, you will see the option named Main Source of Income.

- Here you have to select where you earn your income or what is your source of income.

- Then there is the location of the main source of income.

- Here you have to select the location where your source of income is.

- Then you will see the type of employment/service location.

- From here, select your employee type or select your work location.

- Then click on the Go to Next button.

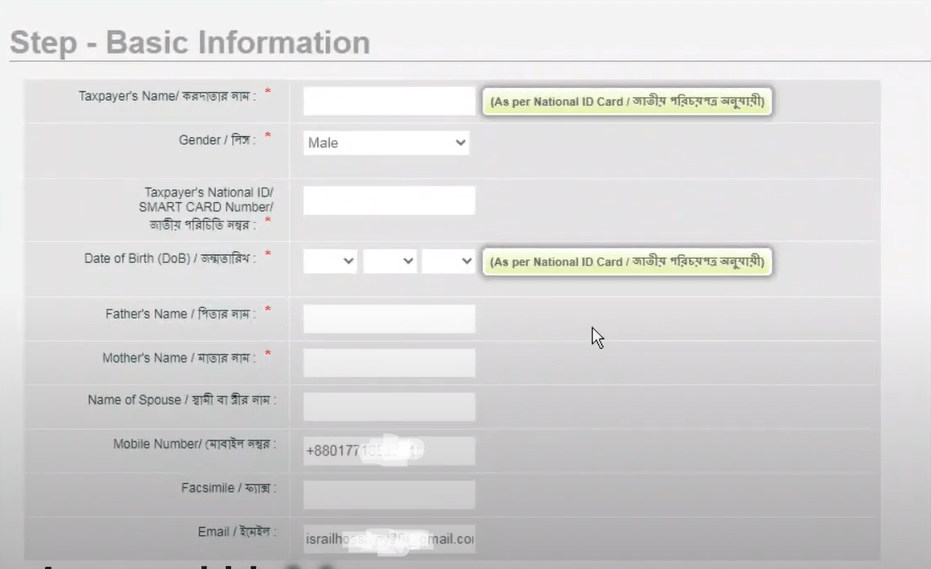

- Next, you have to provide some basic information on the page.

- Your name, date of birth, NID number, parent’s name, gender, sex, etc., should be filled in very well.

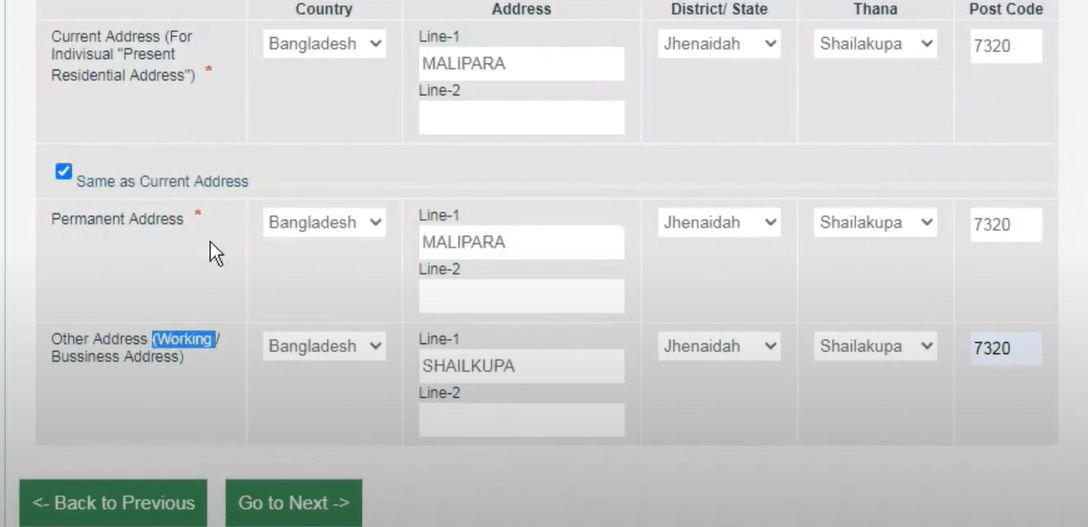

- The next section contains your address.

- Here you have to enter your current address and permanent address.

- If the current and permanent addresses are the same, then there is a check box here to check it.

- Then click on the Go to Next button.

Then all the information you provided will be seen here in a preview form. Look at all the information here to see if everything is correct. If all information is correct then click submit button. Then your TIN will be re-registered.

TIN Re-Registration Status Check

How do you check the status of your TIN re-registration if it has been accepted? To know if your TIN re-registration certificate is ready, you will see the Request status on the left side of the dashboard. Click here to get your TIN certificate status.

Here you can see whether your TIN certificate is pending or accepted. Once the TIN re-registration application is accepted, you can download it. You can download it by clicking on the View TIN Certificate button above.

FAQs About TIN Registration

There are several frequently asked questions about TIN re-registration. We have collected all these questions and answered them below. If you have any such questions, you can check the answer below.

- What is the validity period of a TIN certificate in Bangladesh?

The validity period of a TIN certificate in Bangladesh is five years.

- How can I check the status of my TIN certificate re-registration application?

After submitting your application, you can check the status of your TIN certificate re-registration application by using the reference number provided. You can use this reference number to track the status of your application on the official website of the National Board of Revenue.

- Can an expired TIN certificate be re-registered?

No, it is not possible to re-register a TIN certificate after it has expired. I need to apply for a new TIN certificate.

- Who Needs to Re-Register a TIN?

If you have a TIN and need to update or re-register your information, you may need to re-register your TIN. This includes individuals, businesses, and other organizations.

- What information do I need to provide for TIN re-registration?

You must provide personal or business information such as your name, address, date of birth, and company registration number.

- What happens if I do not re-register my TIN?

Failure to re-register your TIN as required may result in penalties or other consequences. Inability to file taxes or access certain government services. It’s important to keep your TIN registration up-to-date to avoid potential problems in the future.

TIN re-registration is important to make sure taxpayer information is correct. It helps prevent mistakes and fraud in the tax system. If you don’t update your information, you might get in trouble. So it’s essential to follow the rules. The government should make the process easy for everyone to understand and do.