DSCC Holding tax is a direct tax assigned to real estate property owners in South Dhaka. It includes their residential, commercial, industrial, and agricultural property based on the assessed value of their property.

DSCC holding tax works on various municipal services and development projects. DSCC holding tax is used to finance road maintenance, waste management, street lighting, and other civic amenities. holding tax paid by property owners changes depending on the location, size, and type of property they own.

DSCC Holding Tax Online Payment Requirement

A DSCC User ID is first required to pay holding tax online. To register as a DSCC user, visit the DSCC web portal.

- After entering the website, if you scroll down a bit, you will see an option called E-REVENUE; click on the opportunity.

- Now you will see an option called “Create One.” click the Create One Button.

- Enter the required information, such as your name, mobile number, email ID, and password.

- Click on the next Button.

- After a few moments, you will get an OTP on your provided mobile number.

- Finally, enter the OTP to complete your registration.

DSCC Holding Tax Online Payment By Mobile Banking

To make the payment process easier and more convenient for taxpayers, the DSCC has introduced various payment gateways for holding tax payments. These gateways allow us to make our holding tax payments online using different payment methods, such as mobile banking, online banking, credit or debit cards, and other digital payment methods.

Some famous payment gateways for DSCC holding tax payments include bKash, Rocket, Nagad, Nexus Pay, and the DSCC website. These payment gateways are secure, fast, and easy to use, allowing us to pay our holding tax from the comfort of our homes or offices.

DSCC Holding Tax Payment By Rocket

We can make DSCC holding tax payments through Rocket in 2 ways.

- By USSD code.

- By Rocket app.

To pay DSCC holding tax online by Rocket USSD code, you have to follow the steps given below:

- Dial *322# from your mobile phone and select “Payment” from the main menu.

- Select “Pay Bill” from the next menu.

- Select “DSCC” as the biller.

- Enter your holding number.

- Enter the amount you want to pay.

- Confirm the transaction by entering your Rocket PIN.

- You will receive a confirmation message with the transaction details.

You can also use the Rocket app to pay DSCC holding tax online. To do so, follow the steps below:

- Log in to your Rocket app using your PIN.

- Tap on “Pay Bills” from the home screen.

- Select “DSCC holding tax payment”.

- Enter your holding number and the amount you want to pay.

- Confirm the transaction by entering your Rocket PIN.

- You will receive a confirmation message with the transaction details.

Ensure you have sufficient balance in your Rocket account before making the payment. You can contact Rocket customer service for assistance if you face any issues or questions.

DSCC Holding Tax Payment By Nexus Pay

To pay DSCC holding tax online using Nexus Pay, you can follow the steps below:

- Log in to your Nexus Pay app using your PIN.

- Tap on “Bill Pay” from the home screen.

- Select “DSCC holding tax payment” as the biller.

- Enter your holding number and the amount you want to pay.

- Confirm the transaction by entering your Nexus Pay PIN or providing your fingerprint.

- You will receive a confirmation message with the transaction details.

Ensure you have a sufficient balance in your Nexus Pay account before paying. If you face any issues or questions, contact Nexus Pay customer service for assistance. You may want to confirm with the DSCC or Nexus Pay customer service if you encounter any problems or questions.

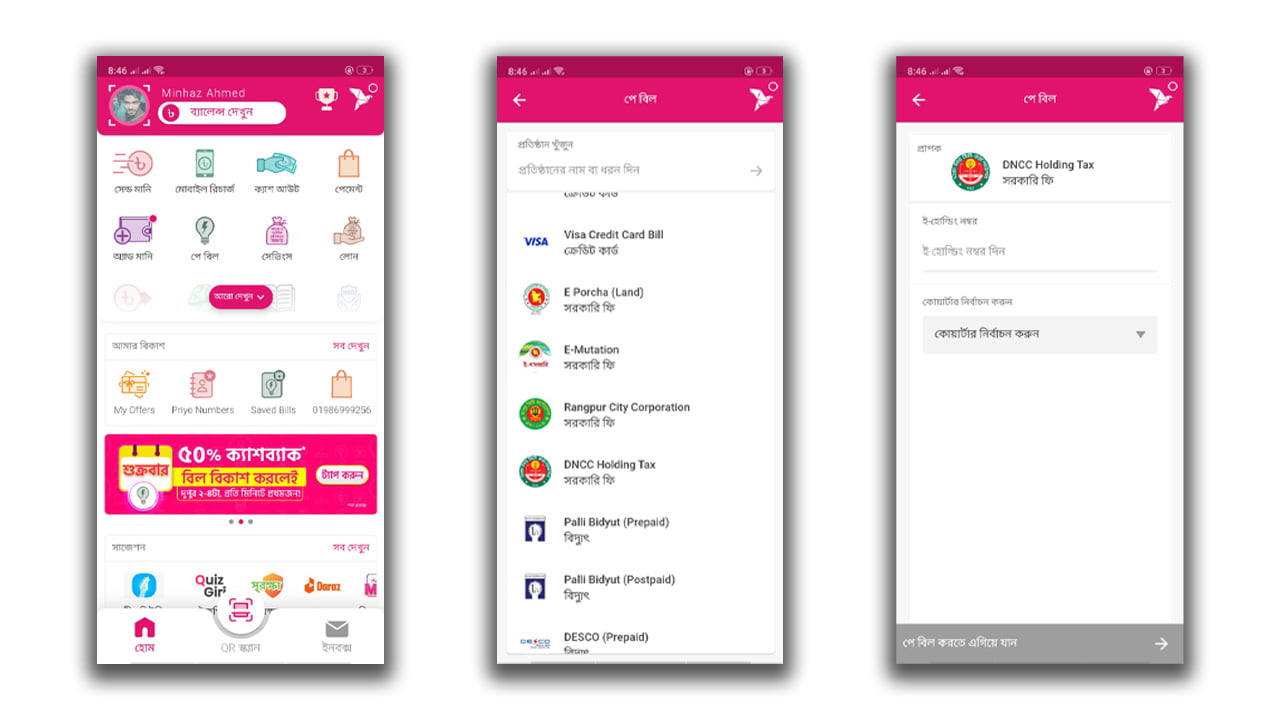

DSCC Holding Tax Payment By Bkash

Bkash is similar to Rocket’s payment method. To pay DSCC holding tax online by Bkash, you can follow the steps below-

- Dial *247# from your mobile phone and select “Pay Bill” from the main menu.

- Select “DSCC Holding Tax payment”.

- Enter your holding number and the amount you want to pay.

- Confirm the transaction by entering your Bkash PIN.

- You will receive a confirmation message with the transaction details.

Alternatively, To pay DSCC holding tax online through the Bkash app, follow the steps below:

- Log in to your Bkash app.

- Tap on “Pay Bill” from the home screen.

- Select “Government fees.”

- Select “DSCC Holding Tax” as the biller.

- Enter your holding number and the amount you want to pay.

Finally, Confirm the transaction by entering your Nagad PIN or providing your fingerprint. You will receive a confirmation message with the transaction details.

Conclusion

We are responsible for paying the DSCC holding tax, which is used to fund various municipal services and development projects.

Property owners have to pay their holding tax annually; if they cannot pay the holding tax, it may result in fines, penalties, or legal action by the authorities.

Therefore, property owners should comply with the holding tax regulations and pay their dues timely and correctly. It is our duty as a conscious citizen of the country.