Personal income tax is based on income earned through a person or individuals. Income tax is one of the most common methods of taxation by the government. The tax is imposed on a person’s total taxable income. The sources of personal income that are subject to tax are:

- Salary and wages from employment.

- Self-employment income.

- Rental income from property.

- Interest and dividends from investments.

- Capital gains from the sale of assets.

- Pension and retirement income, etc.

Income Tax Calculator BD

Personal Taxable income is calculated by deducting certain allowable exemptions, deductions, and credits from the total income. These deductions are expenses related to education, health care, retirement savings, charitable donations, and other qualified expenses.

Calculating income tax can be a complicated process for many of us. For this reason, we do not want to calculate income tax on our salary, but it is not that complicated. You can easily calculate your income tax here – https://rongdhonustudio.com/TaxCalculator.html.

We can improve our financial management by calculating the amount of income tax on salary. by calculating income tax, we can plan our finances and comply with tax regulations.

Individual Income Tax Rate In Bangladesh 2024

According to the schedule of tax rates prescribed in the Finance Act, 2023, the rate of income tax on the total income of every resident individual taxpayer (including non-resident Bangladeshis), Hindu joint family, partnership firm, private association, fund, trust and other taxpayers including artificial persons created by law will be as follows:

| Gross income | Tax rate |

| First 3,50,000 on gross income upto Tk | 0% |

| Next 1,00,000 on gross income upto Tk | 5% |

| Next 3,00,000 on gross income upto Tk | 10% |

| Next 4,00,000 on gross income upto Tk | 15% |

| Next 5,00,000 on gross income upto Tk | 20% |

| On the residual gross income | 25% |

There may be some changes in the personal income tax rate for certain citizens:

- The tax-exempt income limit for female and male taxpayers aged 65 years and above is Tk.4,00,000.

- The tax-exempt income limit for third-gender taxpayers and disabled taxpayers is Tk.4,75,000.

- The tax-free income limit for gazetted war casualties is Tk 4,75,000.

- The tax-free income limit for each child/pet of a parent or legal guardian of a disabled person will be

- Tk.50,000 or more. If both the parents of the disabled person are taxpayers, then either one will get this benefit.

- The tax rate of non-resident individual taxpayers on gross income is 30%.

Income Tax BD

Bangladesh imposes a progressive taxation rate on personal income for citizens and residents present in Bangladesh:

- 182 days or more in the said financial year.

- 90 days or more in the said financial year.

- 365 days or more in the previous 4 years, ranging from 0% to 25%.

The amount of personal income tax is fixed every fiscal year through the Finance Act. Personal Income Tax for the financial year 2023-2024 is mentioned above. You can calculate your income tax rate from there.

How To Pay Personal Income Tax Online

Income tax is one of the main revenue models of the government, which is used for the country’s development. And therefore, income tax is mandatory for every salaried person.

But, if you think paying income tax is tedious, you are probably not familiar with the online payment system. Follow the steps mentioned below for easy online income tax payment.

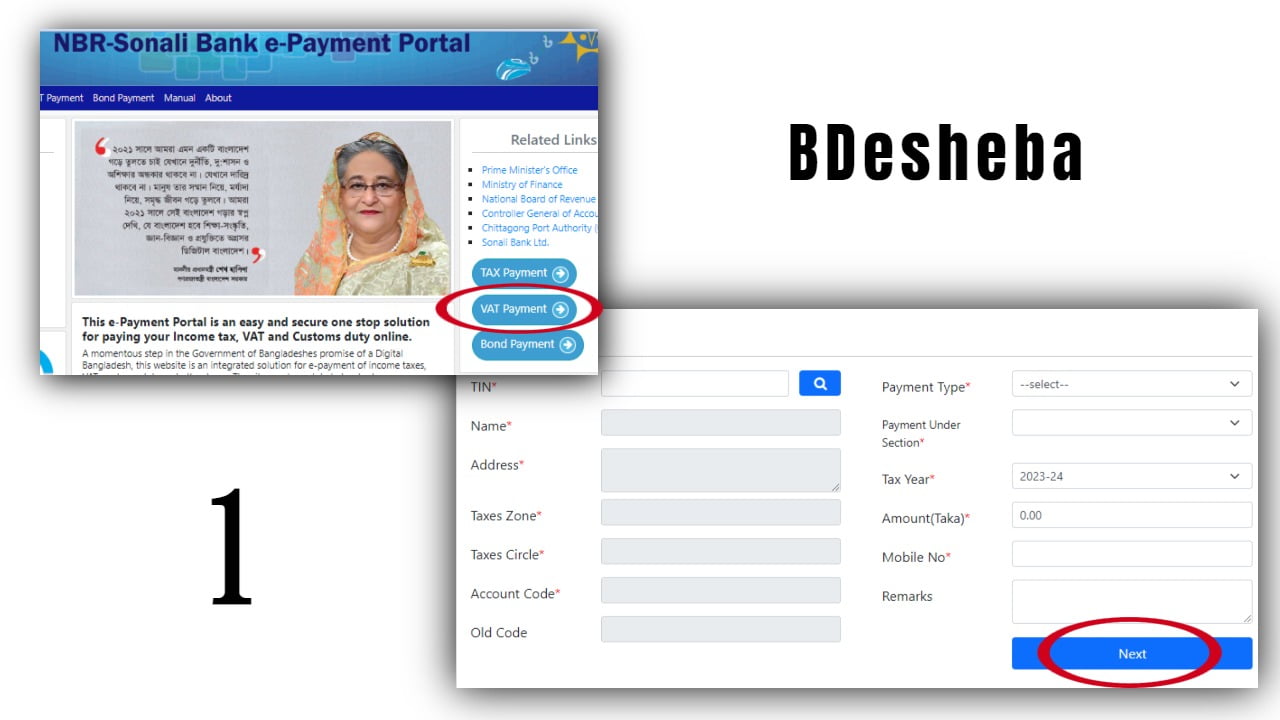

- First, visit NRB’s official e-payment website by clicking this link https://nbr.sblesheba.com/.

- After entering the homepage, you can see the ”Tax payment” option on the right side.

- Click on ”Tax payment”

- A form will appear; fill it with the required information like your name, address, tax zone, tax year, mobile number, etc., and click the ”Next” button.

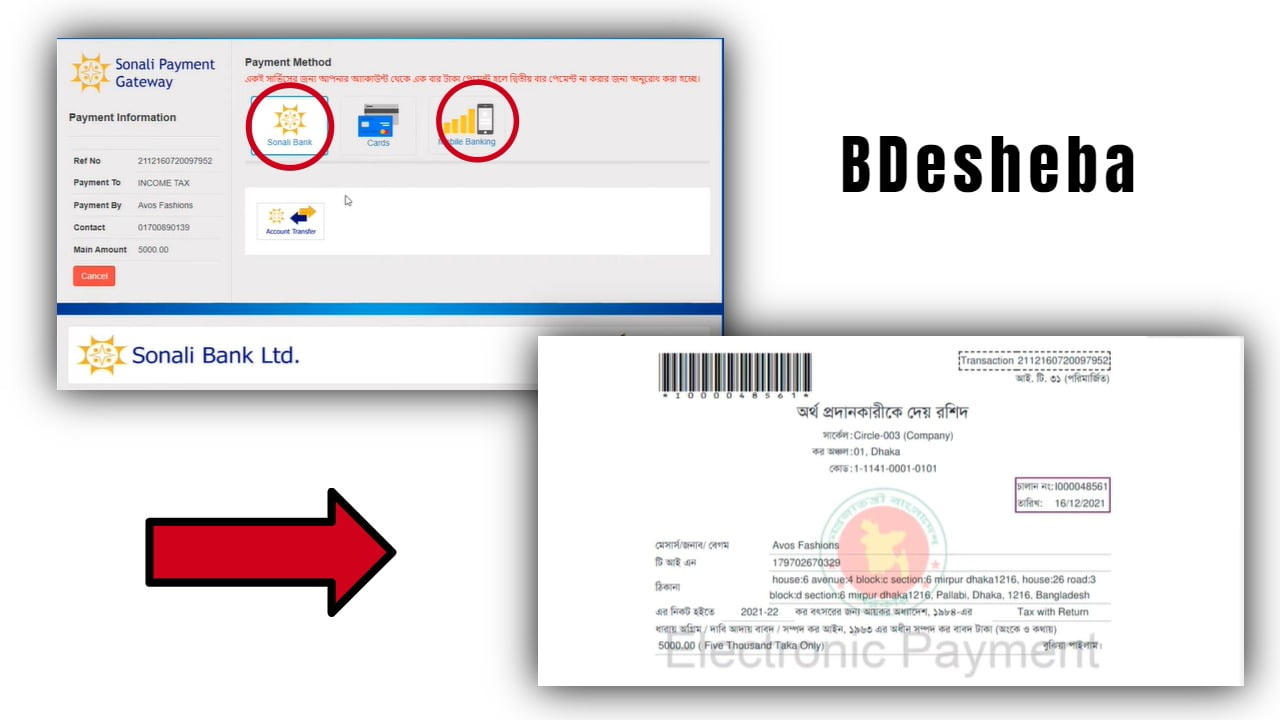

- In the next step, you have to choose the mode of your payment, Debit Card or Mobile Banking.

- After choosing your payment method, provide your necessary payment information and the amount and complete your payment.

- You will receive a receipt after your payment is completed.

Conclusion

Finally, our income tax plays a major role in revenue collection in Bangladesh. It helps the government provide required services and development initiatives.

Again, we must comply with tax regulations, accurately report our income, and follow proper tax planning and applicable tax laws.

You can seek direction from tax authorities or professionals to confirm all information and decisions regarding income tax.

2014 Thaka besnes bondho akhon .E-Tin 2014 thaka 2023 pojunto 0 retan dhakabo ki vabay.