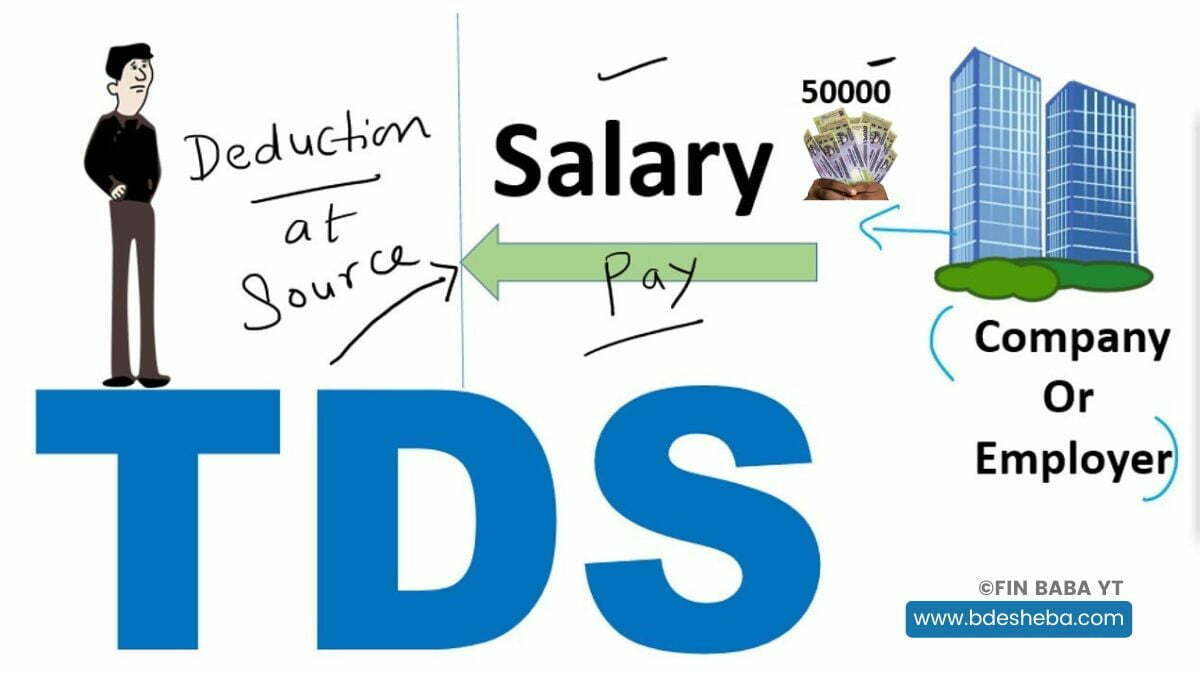

TDS on salary refers to the deduction of Tax by an employer from an employee’s salary when depositing it into their account. The deducted amount is then remitted to the government by the employer. To deduct Tax at source, an employer must first obtain a TAN registration.

TAN or Tax Deduction and Collection Account Number is a 10-digit alphanumeric code that helps the Income Tax Department track TDS deductions and remittances. You can learn about Tax Deducted At Source In Bangladesh In 2023 to be more specific about TDS.

TDS On Salary in Bangladesh In BD

TDS on salary is a tax collection system in Bangladesh, where employers deduct a certain percentage of income tax from their employee’s salaries and deposit it with the government on their behalf. The rate of TDS on salary in Bangladesh is determined by the National Board of Revenue (NBR) and is based on the employee’s income and tax slab.

The employer is responsible for deducting the TDS from the employee’s salary and depositing it in the NBR by the specified due date. This system of TDS on salary helps simplify the tax collection process and ensures taxpayers comply with their tax obligations.

Rate Of TDS on Salary in Bangladesh

It is crucial to keep up-to-date with the latest Tax Deducted at Source (TDS) rates to comply with tax regulations, as they can change over time. According to the tax system In Bangladesh, employers must deduct TDS from their employees’ salaries and remit it to the government within a designated timeframe.

Both employees and employers must comprehend the TDS rate and adhere to the regulations to avoid potential legal issues or penalties.

For Individual Taxpayers

| BDT 250,000 of annual income | 0% |

| BDT 400,000 of annual income | 10% |

| BDT 500,000 of annual income | 15% |

| BDT 600,000 of annual income | 20% |

| Amount over BDT 1,750,000 of annual income | 25% |

For non-individual Taxpayers

| BDT 400,000 of annual income | 0% |

| BDT 500,000 of annual income | 10% |

| BDT 900,000 of annual income | 15% |

Time Limit For Payment Of TDS on Salary

The deadline for payment of TDS( Tax Deducted at Source) on salary is the 7th of the month following the deduction. For example, if TDS is deducted from salary payments made in March, the due date for payment of TDS is 7 April.

still, the duty is outstanding on the coming working day, If the specified TDS payment date falls on a Sunday or a public vacation. TDS must be paid on time. Tax authorities may put interest charges and penalties on failure to pay Tax for any reason.

How To Calculate TDS On Salary in Bangladesh

let me explain how TDS is calculated in Bangladesh. Let’s say an employee earns a gross monthly salary of BDT 50,000, and the TDS rate applicable for the employee’s income level is 10%. To calculate the TDS amount, we can use the following formula:

TDS = (Gross Salary x TDS Rate) Substituting the values in the formula, we get:

| TDS = (BDT 50,000 x 0.10) TDS = BDT 5,000 |

Therefore, the TDS amount for this employee would be BDT 5,000, and the net salary paid to the employee after deducting TDS would be:

| Net Salary = Gross Salary – TDS Net Salary = BDT 50,000 – BDT 5,000 Net Salary = BDT 45,000 |

So, in this example, the employee’s net salary after deducting TDS would be BDT 45,000.

Note: this is just an example, and the TDS rates and calculation methods may depend on the specific circumstances and the applicable tax laws. So, It’s always best to consult with a tax professional or the relevant tax authority for accurate and up-to-date information on TDS calculation.

How To Reduce TDS Rate On Your Salary In Bangladesh?

To reduce the TDS rate on your salary in Bangladesh, you can explore options such as claiming tax deductions, submitting investment declarations, filing your tax return, choosing a lower tax rate, and requesting a tax exemption certificate if you’re exempted from paying. let’s know with details:

- Claim tax deductions for medical bills, retirement savings contributions, and charitable donations. This will decrease your taxable income and lower the TDS rate.

- Provide investment declarations to your employer if you have invested in assets like a house, life insurance policy, or mutual funds. This will also help to reduce the TDS rate.

- File your tax return if you have already paid taxes via TDS. This will enable you to claim a refund of any excess tax paid and reduce the TDS rate for the following year.

- You can ask your employer to deduct Tax at a lower rate if you are compliable with a lower tax rate.

- Again, you can apply for a tax exemption certificate from the NBR. Then, you can submit this certificate to your employer to avoid TDS on your salary, etc.

Leave a Reply