The income tax return is a document that individuals file with the tax authority to report their income, expenses, and other relevant financial information for a given tax year.

This information can be important for individuals to plan their finances, as they can determine when they can expect to receive their refund or when they need to make payment of any tax owed.

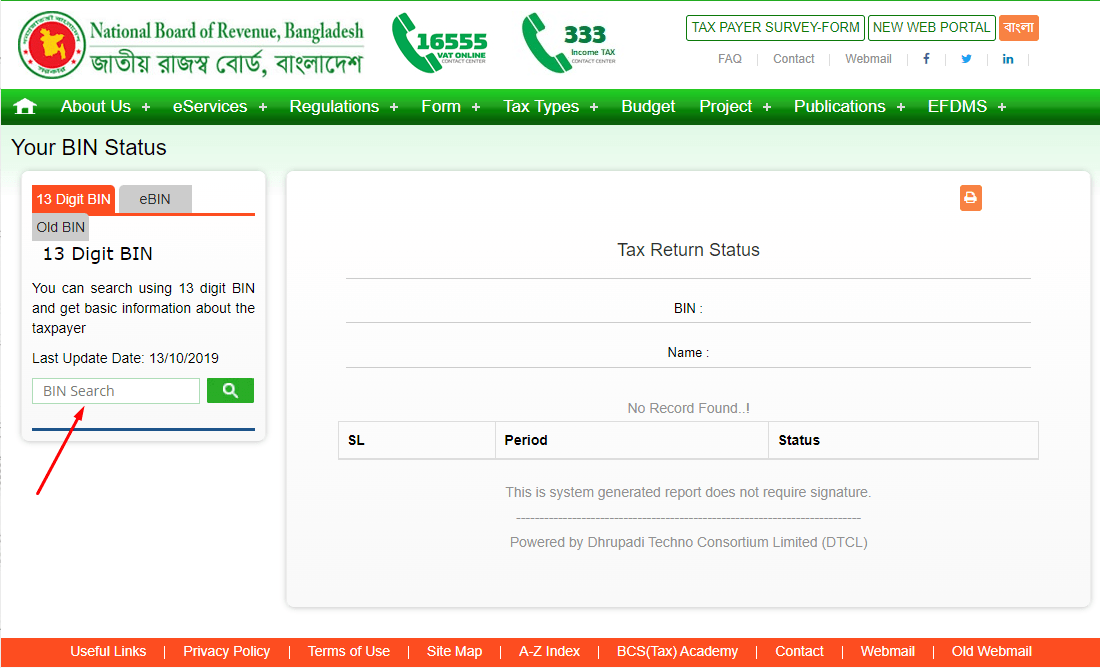

Collect your BIN number and go to the NBR website to check your income tax status. Put your BIN number and click on the search button.

Income Tax Return In Bangladesh

Income tax return status refers to the status of an individual or company’s income tax return, which can be checked online through the National Board of Revenue’s website.

The income tax return is a form that individuals and businesses must submit to the tax authorities each year, declaring their income, expenses, and other financial information.

The status of the income tax return can be one of several categories, including submitted, verified, approved, rejected, or pending. Checking the income tax return status is important in ensuring compliance with tax laws and regulations.

Necessity For Tax Return Status Check

The necessity for a tax return status check arises from the importance of complying with tax laws and regulations. Filing an income tax return is mandatory for individuals and businesses in many countries, and failure to do so or submitting incorrect information can result in penalties and fines.

Therefore, it is crucial to check the status of the tax return to ensure that the tax authorities have received it. Checking the status of the tax return also helps individuals and businesses identify any errors or omissions in the tax return and correct them before the deadline.

Furthermore, in some cases, a tax return status check may be required to apply for loans, visas, or other important documents. Overall, checking the status of the tax return is essential for everything.

Income Tax Return Status Check Process 2024

An income tax return status check refers to checking the status of an individual or company’s income tax return. The income tax return is a document that individuals and businesses must file.

Checking the income tax return status is an important step in verifying that the tax return has been received by the authorities, processed, and either accepted or rejected.

Individuals and businesses can ensure they comply with tax laws and regulations and avoid potential penalties or fines by checking their income tax return status.

Income Tax Return Check Online BD

A 13-digit BIN number will be required to check any business’s income tax return status. As a businessman, anyone has a BIN number.

When you check the income tax status online, you have to check the income tax status with the BIN number.

- To check the income tax status, one must visit NBR’s Income Tax Return Status website.

- After entering this website, an interface will appear.

- Here the 13-digit bill number should be written. Then clear the robot option.

- After doing this, click on the search button.

- Then a new interface will appear and show all the information about tax return status here.

According to the income tax BIN number, the name, serial number, and status of the person who has paid the tax can be known.

You can check all the information on whether the income tax has been received, when it has been received, and which fiscal year the income tax belongs to.

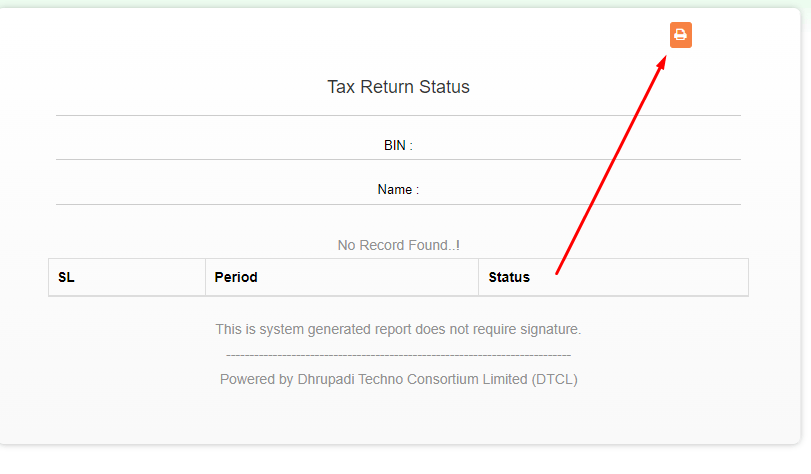

Tax Return Status Copy Download

In many cases, the status copy of the tax return may be required to be downloaded because the status copy of the tax return needs to be downloaded as proof.

When you check your tax status online, you will see the option to download or print the tax return status copy above.

You can download it in PDF format or print it directly by clicking here.

How to Check Income Tax Return

If you have paid personal income tax and want to check your income tax return and download an online copy, then you can follow this article Income Tax Return Check Online.

Here all the process of how to check income tax return is well mentioned. By following this, you can check your income tax return and download your tax return.

Last Words

Knowing one’s Income Tax Return Status is crucial for individuals to stay updated on their tax returns and to plan their finances accordingly.

By regularly checking their tax return status, individuals can ensure that their returns are being processed correctly and that any issues or errors are resolved in a timely manner.

FAQs

- What does it mean if my Income Tax Return Status is “Processing”?

Ans: If your Income Tax Return Status is “Processing,” the tax authority has received your tax return, and is being reviewed and processed.

- What should I do if my Income Tax Return Status shows that I owe money?

Ans: If your Income Tax Return Status shows that you owe money, you should make payment as soon as possible to avoid any penalties or interest charges.

- Can I change my Income Tax Return Status after filing my return?

Ans: No, you cannot change your Income Tax Return Status after filing your return. However, you can still make corrections or amendments to your return if necessary.

- How long does it take for the tax authority to process my tax return?

Ans: The processing time for tax returns can vary depending on the country and the complexity of the return. Generally, it can take anywhere from a few weeks to several months to process a tax return.