In Bangladesh, a zero income tax return is a type of tax return filed by a taxpayer with no income to report. This type of return is typically filed by unemployed taxpayers or those with very low incomes. While a zero income tax return may not result in a refund, it can help to reduce the amount of taxes owed.

Today’s discussion is mainly about zero income tax returns. Many people do not know zero income tax and how to pay it.

Today’s discussion can help you get a clear idea about zero income tax, and it can help you file income tax. So let’s read the discussion carefully from beginning to end

Zero Income Tax Return Information

Many of us do not understand the difference between taxable income tax returns and zero income tax returns. Many people do not have a clear idea about whether they have to pay any amount for income tax on zero tax returns.

Basically, a zero income tax return is an income tax return where the individual has to file only an income tax return. But no money has to be paid for income tax.

If a person has a TIN and his income is within the tax-free income limit, he will file a zero income tax return. Tax-free income limits vary from individual to individual. So let’s know what the tax-free income limits for individuals are –

- Annual taxable income of TK 3,00,000 or less in the case of the male taxpayer.

- Female taxpayers, taxpayers aged 65 years or above, and taxpayers of the third gender with an annual taxable income of TK 3,50,000 or less.

- In the case of gazetted war casualties and freedom fighter taxpayers, the annual taxable income is TK 4,75,000 or less.

- For disabled taxpayers, annual taxable income is TK 4,50,000 or less.

So if a person’s income is within the above tax-free age limit and if he has TIN, he must file a Zero income tax return. If a person has no income but has a TIN, he must file an income tax return.

But if an individual’s annual income is within the tax-free age limit and does not have a TIN, he does not have to file an income tax return. A person with a TIN must file an income tax return. However, there may be some exceptions in this case. For example-

- If a person has an e-TIN for a credit card and his income is within the tax-free income limit.

- If a person takes e-TIN for the sale of land and his income is within the tax-free income limit.

- If a person is a non-resident who has no fixed base in Bangladesh.

However, if a person wants to file an income tax return voluntarily after fulfilling the above conditions, he can do so. Anyone can easily prepare his or her zero income tax return with BD Tax’s automated software.

E-Return Registration Process

Now let’s know how to register the e-return system. You must have your TIN certificate to register. Without it, you cannot complete the registration process. So let’s know how to register.

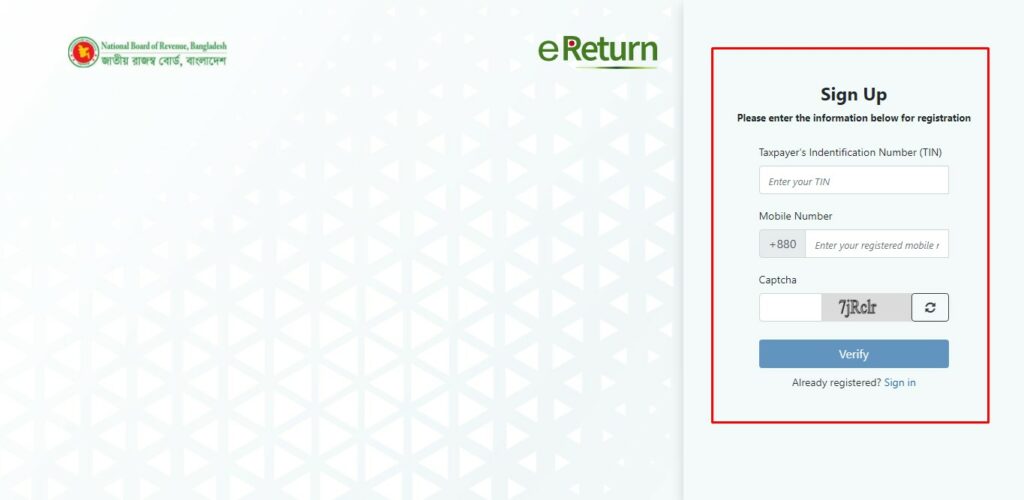

First, you must visit the National Board Of Revenue, Bangladesh website for e-return registration. After entering this link, you will see a page like the below image.

Here the red-marked symbol means in this section, you have to enter your TIN and a mobile number to verify. And below, you will see the red-marked symbol means that in this part, you have to enter your mobile number to verify. Then below, you will see a captcha given. This captcha must be filled in correctly.

After doing this, click on verify option. Then you will be taken to a new page where your mobile number will be verified. You will be sent an OTP on your phone. Enter this OTP here.

After entering the OTP, you will need to set up a password. You must set up a strong password and remember it. Write it down somewhere to remember.

Once the password is set up, click the submit button. Then your registration process will be completed, and you can complete your e-return submission.

E-Return Submission Process

Many people want to know how to complete e-return submissions. Doing this requires you to go through several steps in which you must provide some information with a lot of caution, which is quite time-consuming. You can visit the link below to submit your tax return.

READ: Online Tax Return Submission Process 2023

Here the return submission process is discussed straightforwardly, step-by-step. I hope you can quickly complete the e-return submission from this article.

So far, in today’s discussion. I hope you have learned details about zero income tax and e-return submission from today’s discussion.

I hope this article will help you with e-return income tax and help you to complete your e-return submission. You can follow our website to get regular updates regarding e-return. Thank you very much for being with us.

কিবাবে দেখবো