Paying taxes is an essential civic duty that helps governments fund public services and improve the quality of life for their citizens. DNCC has shown understanding by extending the holding tax till September 30.

Residents can clear their 2021-2022 dues without fines or surcharges. Mayor Atiqul Islam appeals for prompt action to benefit from this relief.

In this discussion, you will get the concept of holding tax, its calculation, payment methods, benefits, and consequences of non-payment.

What is a Holding Tax?

Holding tax, also called property tax, is the yearly fee you pay to your local government for living in your place.

This money helps them take care of important things in the area, like fixing roads, keeping the streets clean, maintaining parks, and ensuring the sewage system works well.

Paying your holding tax on time is like being a good neighbor and helping your community stay nice and enjoyable for everyone.

Dhaka North City Corporation (DNCC) Holding Tax

DNCC is the governing body responsible for administering municipal services in the northern part of Dhaka, the capital city of Bangladesh.

It covers an extensive area and maintains public facilities, waste management, road infrastructure, and other essential services.

Several factors influence the calculation of holding tax, including the property’s location, type, size, age, and current market value. The DNCC assesses each property individually to determine its taxable value.

DNCC Holding Tax Rate

When a new house or building is constructed, altered, or developed, the responsible Revenue Supervisor of the respective area submits the Nobadi Form to determine its tax assessment.

Subsequently, a notice of hearing is issued to the property owner within 7 days, along with a requirement to submit necessary documents as per Section 26(2) of the relevant law.

Dhaka, North City Corporation, has boldly boosted urban development by raising property tax to TK 24 per sq ft. Besides, a 12 percent holding tax will also be levied. This innovative tax reform aims to increase revenue and promote responsible property ownership.

A significant milestone in the taxation process comes into play each year as an annual tax is imposed at a fixed rate of 12% on the yearly determined valuation of properties.

The 12% tax rate is carefully calculated based on the property’s assessed value, taking into account various factors such as location, size, amenities, and other relevant considerations.

How to Pay DNCC Holding Tax

Property owners in DNCC can choose from various payment methods to fulfill their holding tax obligations. Holding tax can be paid through the bKash, Nagad, or Upay app by visiting the holding tax payment website. Now holding tax payments is done online method.

DNCC Holding Tax Payment Online

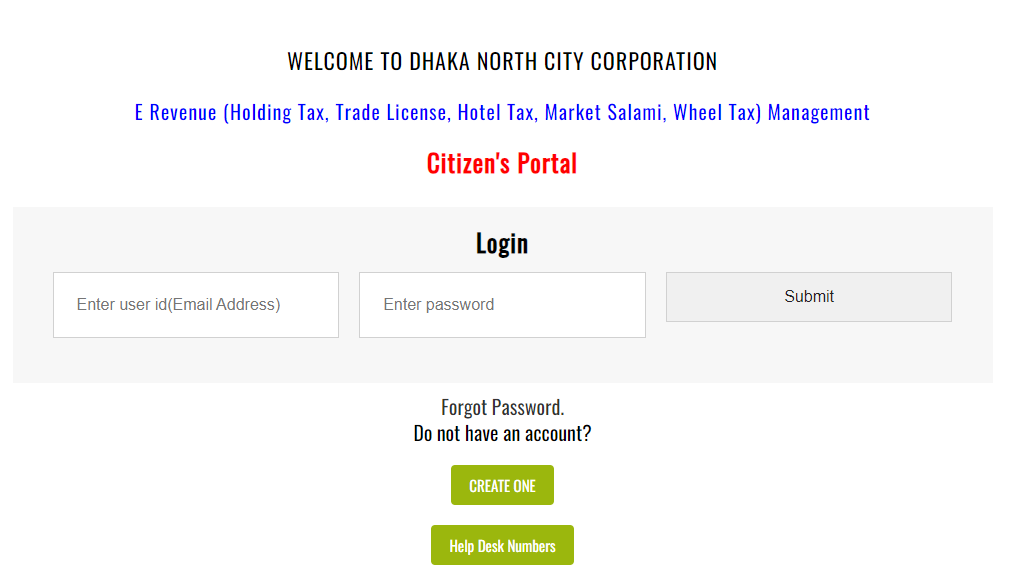

DNCC has an online platform where property owners can register their properties, calculate their holding tax, and make secure payments through digital methods.

Follow the procedure below on how to pay your DNCC Holding tax online.

- Visit the Dhaka North City Corporation Holding Tax Payment website.

- To pay the holding tax, log in here with your user ID and password. If you don’t have a user ID and password, open an account by clicking the Create Account button.

- After Creating an account, log in to the website.

- After logging in, you will get various tax payment options.

- Select the holding tax option.

- After that, provide the required information correctly.

- Here, you have to provide your holding number. Then, the total tax will be shown here.

- Then select the payment option. If you have one, you can pay the tax through a bank account, bKash, Nagad, or the Upay app.

- Then, provide your account information and complete the payment.

- Finally, download the tax payment receipt.

FAQs

- What is the due date for holding tax payments?

Ans: The due date for holding tax payment is specified by DNCC and must be paid every 4 months.

- Is holding tax applicable to commercial properties only?

Ans: No, holding tax applies to all types of properties, including residential, commercial, and industrial.

- What happens if I fail to pay the holding tax on time?

Ans: Failure to pay the holding tax on time may result in fines, penalties, and legal actions by DNCC.

Conclusion

Paying holding tax is not only a legal obligation but also a civic responsibility that contributes to the growth and development of Dhaka North City Corporation.

Property owners actively participate in building a better and more sustainable city by fulfilling this duty.

Additionally, timely holding tax payments enable DNCC to provide essential services and improve the overall living conditions for its residents.

Leave a Reply